Retail Investors Crushed

I have said it hundreds and hundreds of times. Everyone ignores, this newsletter is tiny. It’s fine, it’s cathartic. It’s all about me, anyways.

a. You need to check your reliance on financial markets returns, and and then check your inner self, to see if they match. There isn’t a specific timeframe, like every quarter or year. No one is going to tell you when the next checkpoint is. From there, the next one might not arrive for a month or longer. “Stocks in the long run” is what you hear. Fine in theory or in Statisticsville. I am trying to help you understand that financial markets do not care about historical data, your politics, nor your philosophy. Markets vote, around the clock, on the prospect of the future. Period.

b. You need to accept that things can go wrong for a long list of reasons. Some may be beyond your control. Yesterday’s tariff announcements were more dramatic than the most extreme predictions. However, they were not entirely news, most of it was known, for the most part. It was the extent and amount that caught the markets off-guard. Some of the reasons are within your control, like a lack of knowledge (yo). You may need to fight to keep them separate.

c. You need to know what your balance between a & b are, that they can change, and that blowing this off will eventually stop working. You have your own stuff to deal with, and I don’t care what they are, it is none of my business. EXCEPT that they would tell me what the balance between a&b should be. Eh, so I guess I do care. When you don’t realize that a & b & c need to coherently work together, you get exposed, and only then do you see it. You are not alone, I promise you that.

What a “Coincidence” That I am Making This Point Today!

You may have heard, the financial markets declined today. Retail investors were ill-prepared. What a surprise (not).

Before (this was in Morningstar and you can see the date, 2/6):

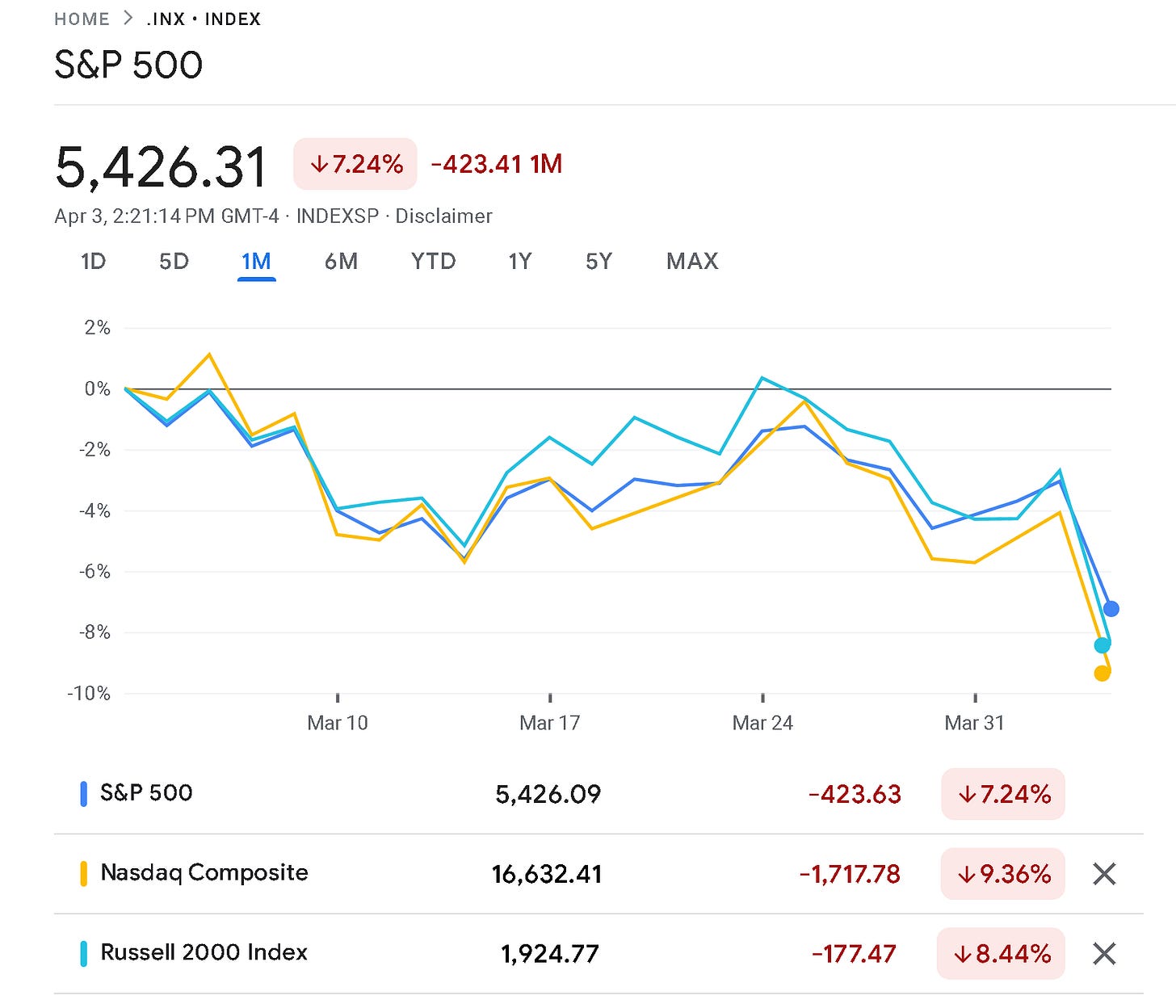

After, measured on 4/3, only two months later. So if you bought and thought about some fixed date in the future? Sideswiped, this was the past month, shaded in pink.

Welcome to the “We I Already Talked Wrote & Made Videos About This” Newsletter

Sigh. Anyways…

When it’s tough, you may need to adjust accordingly.

Following the crowd, just because? What could possibly go wrong? You first, thanks, I’ll hang back a bit.

It Is Tricky Though, I’ll Give You That

Beware of those who are searching for eyeballs rather than accuracy.

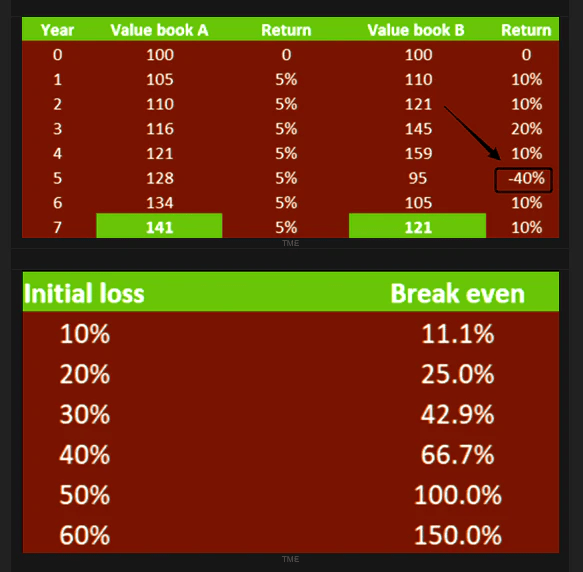

If anything, I owe an apology to the actual Bozo the Clown, who I watched in the morning when my parents weren’t paying attention, and (not the fake one in the thumbnail here). The fake clown’s recommendation at the time, which was always wrong: 80% allocation to the S&P500 and 8% annual withdrawal rate from retirement savings. Those were the long-run recommendations. This public quote didn’t last 6 months, but the reality it was wrong the moment it came out his mouth. He has earned every bit of the derision here. Every. last. bit. This is almost the nicest possible way I could’ve stated this.

Academically wrong, market reality wrong, no experience from the actual playing field, and a large audience: that cannot be a great combination. You’re not alone.1

This doesn’t even show the withdrawals.

How to Move Forward: One Simple Thing To Remember

Pride is overrated.

Communicating financial knowledge actually feels personally terrible, awful, because I know how far away the desired, necessary endpoint is. It’s far better to talk to a 27 year old about this stuff. There is less to unwind, undo.

We don’t have a retirement crisis. We definitely have a knowledge crisis. 100%.

Some people don’t know what to ask, they don’t know where to start. Some people think there is no reason to do it today, it can wait. Some people cancel the free information provided in this Newsletter. OOOH, I lied, there is a Second Simple Thing to Remember: Don’t Give Away Free Options.

Professionally, this is very rewarding. I nag for information, I drone on, with excess information. It’s true! But now…Comprehensive Planning clients have already been told, months and months and months ago, that something hasn’t been quite right since the Yen Carry Trade episode during August last year. The Yen Carry Trade problem revealed something important in the depths of complicated international finance, and it appeared, to remind me, “Yep, I am still here.” I have tried to explain it.2

Nevertheless, risky assets levitated out of relief, and then a bunch of other stuff that didn’t fit together, it simply didn’t jive. For the stable, randomly higher, walking the line between “just good enough” was going to have to suffice. I kept warning people: “Don’t expect this type of environment every year, randomness was enormously in your favor.” I am sure that some grew tired of it. Today, losses could not be avoided, but excess worry did not enter the picture because preparation for these days was already established.

The stable3 has earned my respect because they understand the difference between process and preparation and knowledge and dedication, versus the end result. At some point along the way, a light goes on. This annoying guy cannot possibly be faking it, and what they receive are facts in plain view. That’s easy for me because I realize that many are better than I am at arithmetic. Pfft, no problem, next.

That said, I don’t feel bad, at all, for Mr Know-It-All. I get this a lot. False confidence is a great behavioral bias in finance, and sometimes used weirdly. “I’ve been doing this for XXX years.” “We’ve got it under control.” In the back of my mind, there were no statements to suggest that was the case. “You have no idea what you are doing” doesn’t seem like it would be an appropriate statement to make, I dunno, I am no good at marketing, but that statement doesn’t feel right, even if true.4 Yeah, I remember your names and faces.

We have an 18-year old as the king of Chess, an 18-year old as the Van Cliburn winner, and a 20-year old with 9 Grammys (“I have taken out my Invisalign, and here is the album” has to be one of the great age-is-nothing-compared-to-talent-and ability lines, ever).

And Yet: Start Where You Are

I am sure that you can get it. I already know this. Some of you have technical abilities that I will never hope to match. Some of you have been to the school of hard knocks that I have never experienced. Some of you have faced the impossible. Those can all be used in your favor.

SUNDAY APRIL 6, 10AM ET on YouTube

Press the image, and turn on the notification bell =). See you Sunday at 10AM ET, you can bring your questions, or send me an email to: info at gh2benefits.com.

Read more

#Play #Game