Short-term vacation rentals outperformed traditional hotels across all U.S. regions in the second quarter of 2025, marking a notable shift in the travel accommodation landscape, according to new data from Key Data, which tracked more than 13 million listings nationwide.

The firm’s latest U.S. Vacation Rental Market Index revealed that short-term rentals (STRs) delivered a nine-percentage-point lead in RevPAR (revenue per available rental) over hotels during Q2–underscoring their resilience amid mounting economic headwinds in the broader travel and hospitality sector.

“This quarter’s results are a reminder that short-term rentals continue to offer a compelling value proposition for investors and travelers alike,” said Melanie Brown, VP of Data Insights at Key Data. “Despite macroeconomic pressure, demand held strong.”

Yet beneath the headline growth lies a more fractured market. While the STR sector remains a magnet for capital, performance is becoming increasingly uneven across regions and operators. Market-level fundamentals and operational strategy are now more influential drivers of returns than the asset class alone.

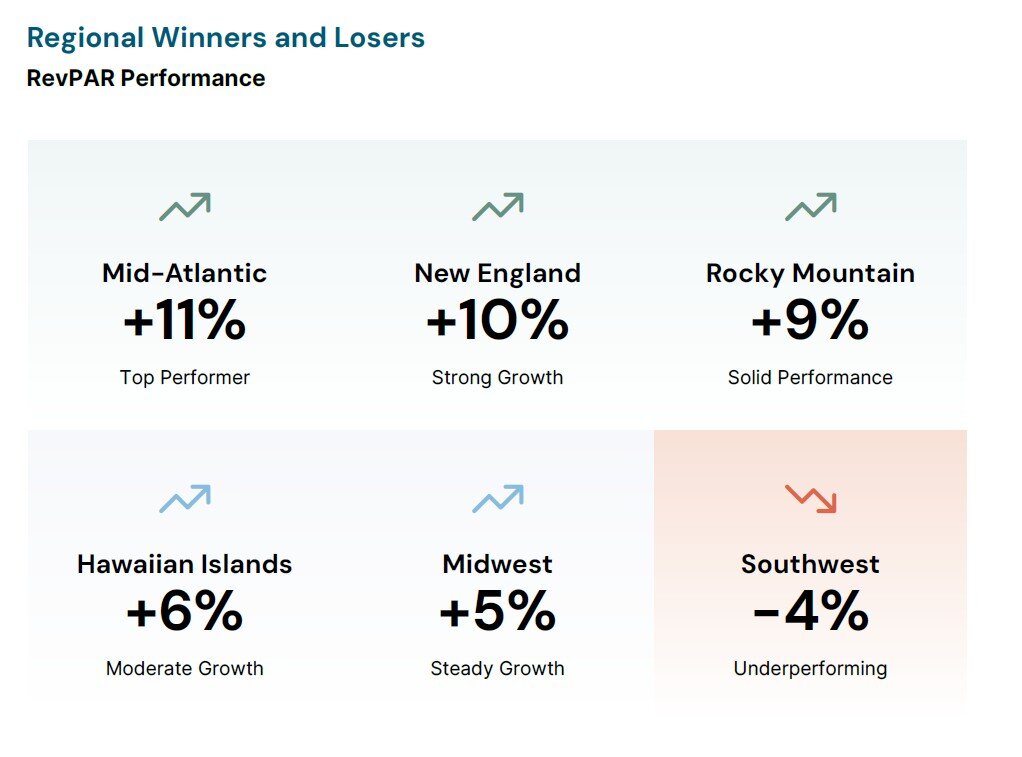

Regional Performance Highlights:

- Mid-Atlantic: RevPAR rose 11% year-over-year, with a 10% jump in occupancy.

- New England: Up 10% in RevPAR, buoyed by premium pricing and strong seasonal demand.

- Rocky Mountains: Posted a 9% increase, reflecting sustained travel interest.

- Hawaii: Delivered a 6% RevPAR gain, maintaining rate strength in a high-cost market.

- Southwest: The sole underperformer, with a 4% RevPAR decline due to supply-driven rate compression.

The widening performance gap reflects a broader shift in STR market dynamics. “Returns are no longer uniform,” Brown noted. “Success increasingly hinges on the operator’s ability to price dynamically, manage expenses, and respond to regional demand shifts in real time.”

Trouble Ahead?

Despite a strong second quarter, warning signs are emerging. Forward occupancy for September is down 11% year-over-year, and booking windows have shortened notably across key summer months. That compression is forcing both travelers and operators to make quicker decisions, often with less visibility.

For asset managers and investors, the message is twofold: STRs remain a high-performing asset class, but the margin for error is shrinking. Operator agility, real-time data, and localized strategy are becoming critical differentiators in a more volatile demand environment.

“Some markets are accelerating, others are softening–and these trends aren’t always easy to predict,” Brown added. “With headwinds building into the back half of the year, staying close to the data will be key.”

As travel behavior continues to shift and macro conditions evolve, the short-term rental sector may be entering a new era–one where growth is still achievable, but precision is paramount.

Real Estate Listings Showcase

#Shortterm #Vacation #Rentals #Outperform #U.S #Hotels