Key Points

-

The most recent Social Security Trustees’ report said that Social Security will deplete its trust fund by 2033.

-

New legislation will affect the amount of revenue collected by Social Security through 2028.

-

Congress can act to ensure the health of Social Security, but the longer it waits, the harder that gets.

- The $23,760 Social Security bonus most retirees completely overlook ›

The most recent Social Security Trustees’ report said that Social Security will deplete its trust fund by 2033.

New legislation will affect the amount of revenue collected by Social Security through 2028.

Congress can act to ensure the health of Social Security, but the longer it waits, the harder that gets.

The government celebrated the 90th anniversary of the Social Security Act becoming law this month, but the program could look very different before it reaches 100.

The Social Security Board of Trustees publishes an annual report detailing the financial status of the program. That includes projections over the next 75 years for both the Disability Insurance (DI) Trust and the Old Age and Survivors Insurance (OASI) Trust. The latter is the fund used to pay out retirement benefits to over 60 million Americans.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Unfortunately, those projections show that those Americans will soon face a significant cut in benefits unless Congress acts to change the Social Security laws. The Trustees’ report, published in June, showed that the program would fully deplete the trust by early 2033. At that point, the report estimates that incoming revenue will be enough to pay out 77% of scheduled benefits.

But we received another update on those projections from Social Security’s Chief Actuary, Karen Glenn, in August. Here’s what’s new, and how it affects future benefits.

Image source: Getty Images.

Why is Social Security facing benefit cuts?

Before we get into the details of Glenn’s update, it’s important to understand what exactly is causing Social Security’s Trust Funds to run out of money.

Social Security started collecting tax revenue from every American’s paycheck starting in 1937. It placed all the funds into a trust to pay out future benefits. In the meantime, the trustees invested those funds in safe government bonds to earn a bit of interest on the principal.

When it started paying out monthly benefits in 1940, the program was still bringing in more revenue than it was paying out in benefits. A growing working-age population and a growing economy combined to put Social Security on solid footing. Those trends generally worked in favor of Social Security as baby boomers entered the workforce, creating a massive surplus in Social Security while they were working.

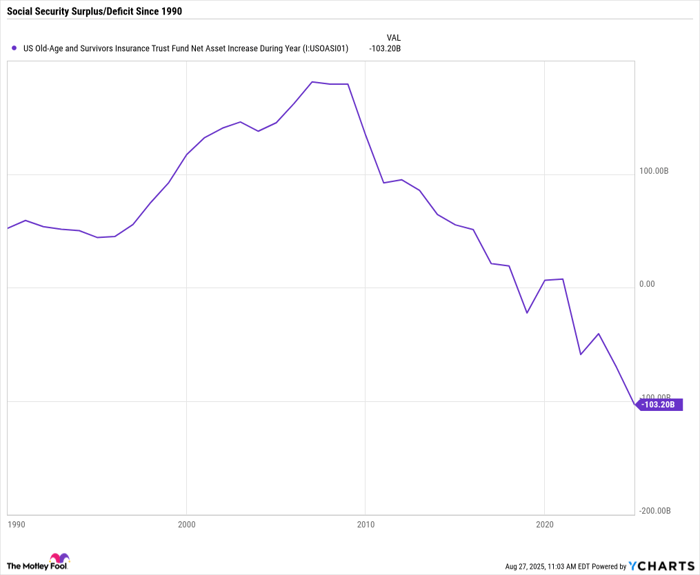

But the demographic trends are shifting. People are living longer and the working population isn’t growing as fast. With the baby boomers now mostly retired, the ratio of retirees collecting Social Security to working Americans has dropped over the last decade. That’s resulted in the Social Security OASI Trust running a deficit for the last three years.

U.S. Old-Age and Survivors Insurance Trust Fund Net Asset Increase During Year data by YCharts.

That deficit is only going to grow bigger and bigger over the next few years as more retirees start collecting benefits and revenue sources don’t keep up. There are notably three revenue sources for Social Security: Taxes on wages, interest income from its invested assets, and taxes on Social Security benefits themselves. Unfortunately for retirees depending on Social Security, recent legislation negatively affects one of those revenue sources.

The most recent update from Social Security’s Chief Actuary

Senator Ron Wyden (D-Ore.) wrote to Chief Actuary Glenn asking her to assess the effect of the recently passed tax law on Social Security. While the new law, the One Big Beautiful Bill Act, doesn’t directly cut taxes on Social Security income, it extends the 2017 tax cuts and provides seniors age 65 or older with an additional tax deduction, which could reduce the amount of Social Security benefits subject to taxation.

Glenn found that the new law would indeed decrease the amount of revenue collected by Social Security, resulting in a net increase of $168.6 billion in Social Security’s costs over the next decade. As a result, she now expects the program to deplete the OASI Trust Fund by the fourth quarter of 2032, instead of the first quarter of 2033.

While Glenn doesn’t provide projections on how big the benefit cuts will be under the new tax law, retirees should expect to see cuts similar to the 23% outlined in the full Trustees’ report. The new tax act only extends until 2028 before reverting to pre-2018 tax laws. However, it’s important to note that the demographic trend leading to the deficit will only continue to worsen, which means the benefit cuts will get bigger each year.

Will Congress let your Social Security benefits get slashed?

The current law doesn’t allow Social Security to pay out more than it’s collected in revenue. Once the program depletes its trust fund, it will have to slash benefits — unless Congress acts.

Congress could take steps to prop up Social Security while making changes to the program to put it on a course to long-term financial health. However, any action it takes is best done sooner rather than later.

Unfortunately, Congress is moving in the other direction. The new tax law touts the benefits it provides to seniors on Social Security, but the truth is that those benefits don’t help those who need it most. At the same time, it’s accelerating the countdown until all retirees face benefit cuts.

Considering the importance of Social Security to the American voting population, it’s unlikely that Congress will allow the program to fail. But prioritizing short-term benefits over the long-term health of the program shows that this Congress is willing to kick the can down the road a few more years, which could result in severe changes for everyone. As I said, Social Security will look a lot different by the time it reaches its 100th anniversary.

The $23,760 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Join Stock Advisor to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Social #Securitys #Chief #Actuary #Updated #Timeline #Potential #Benefit #Cuts #Heres #Stand