Well, Secretary Bessant was correct after all, the initial announcement was the “upper limit” of the tariffs.

-

Bond market screamed, pause for 90 days [10% remains]. Fold. Announced Tuesday.

-

Exemption for semiconductors and consumer electronics. Fold. Announced hours ago, today.

-

10% tariff remains (as far as we can tell).

Rhetorically speaking, what got accomplished, exactly?

-

The US looks weak and vulnerable. On Election Day, I wrote “Elections Won’t Fix This.” I don’t think that Premier Xi and the PRC were thinking “fight until the end” meant by the time this year’s Masters champion was decided. All that happened is that any existing, originally-false pretense, is now in full view for everyone to see.

-

The people in the US who will be hurt the most? Those who can afford it least. Any tariff is a regressive tax.

-

Jae’s Rib Shack still has the trifecta of problems. My employees don’t show up for work, since they are trying to avoid ICE. My raw ingredients are either unavailable or more expensive. My customers, who could barely afford to eat out at my fine establishment, their EBT cards are running out. My plans for Jae’s Rib Shack? Survive. Any other plans for the future, regarding the prospects of the best rib shack on the planet? Get outta my face, we were on thin ice to start, and now it just got worse.

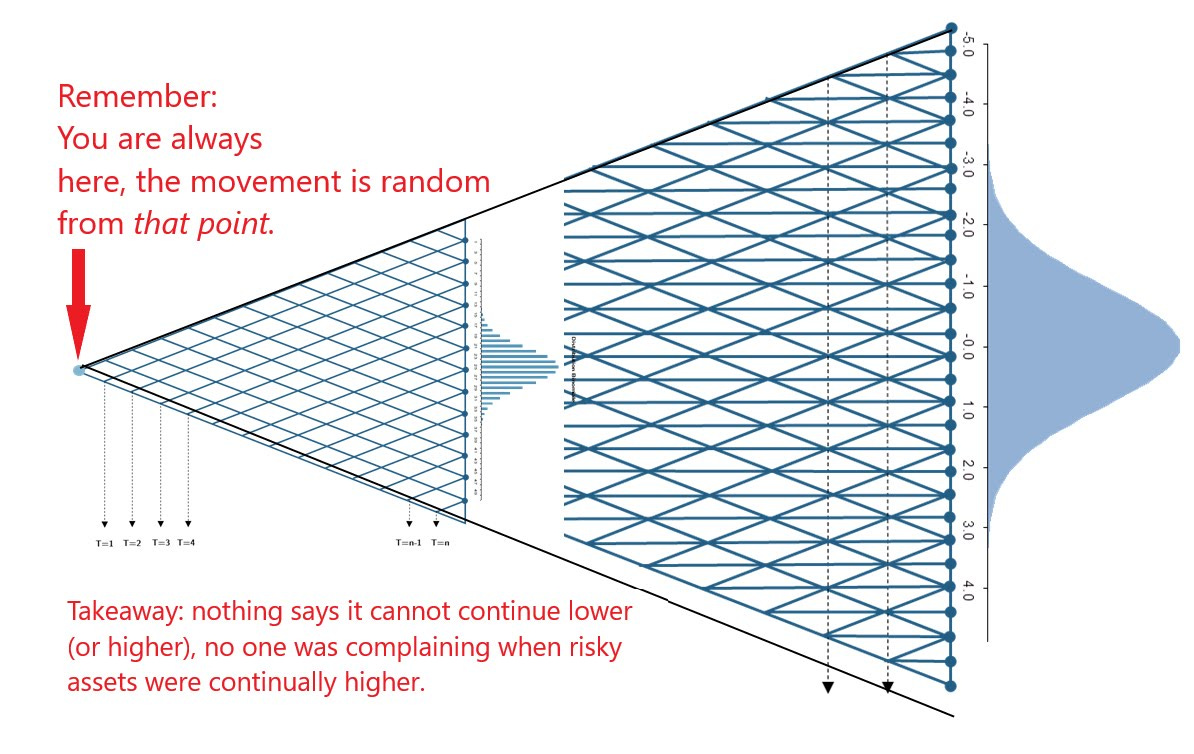

Perhaps, the craziest of all? Folding is probably right. The reason is simple: You are at the red arrow, now. Start where you are. We cannot go back and undo points 1-3. The US voting population chose, in a landslide, to put us here.

YouTube Live at 10AM on Sunday April 13

I might be ready for tomorrow, this is the 3rd change of the YouTube thumbnail. Don’t forget to like, subscribe and press the Notification Bell.

There is a reason that one slogan here is “Stocks for Show, Bonds for Dough.”

Borrowing and lending is what keeps the mechanics of finance in motion. The only way the economy functions is if borrowing and lending functions correctly. If it does not, everything grinds to a halt, the weakness gets exposed. If Google reports poor earnings, the economy will continue to function. It is simple as that: a stock doesn’t matter in the scheme of things.

Tell me this: what has actually been accomplished? Other than trillion$ wiped off global stock markets? That said, start where you are. I have ported everything to Spotify, since it now controls the podcast universe. There are audio-only episodes. I realize it’s a lot. There is a lot going on.

Thank goodness for Cass, my AI co-host. You can listen to podcasts on your phone without YouTube or video.

#Art #Folding #Jae