Key Points

-

Precigen stock soared on news that its first drug earned approval.

-

Mineralys is a pre-commercial biotech with a hypertension candidate in late-stage testing.

-

AstraZeneca has a hypertension candidate similar to Mineralys’ that is far ahead on the development timeline.

- 10 stocks we like better than Precigen ›

Precigen stock soared on news that its first drug earned approval.

Mineralys is a pre-commercial biotech with a hypertension candidate in late-stage testing.

AstraZeneca has a hypertension candidate similar to Mineralys’ that is far ahead on the development timeline.

Investors in search of stocks that can produce dramatic gains in a short time frame will want to turn their heads toward the healthcare sector. A handful of stocks in the space more than doubled in price recently.

Shares of Precigen (NASDAQ: PGEN) and Mineralys Therapeutics (NASDAQ: MLYS) have already risen more than 100% since the end of July. Despite the recent run-ups, Wall Street experts who follow these stocks believe they could soar even further.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

1. Precigen

From the end of July through Friday, Sept. 5, shares of Precigen shot 155% higher. The market cheered because the drugmaker earned approval from the Food and Drug Administration (FDA) for its first treatment. Papzimeos is a cell-based immunotherapy for the treatment of recurrent respiratory papillomatosis (RRP), a rare disease that results in tumors lining the respiratory tract.

Papzimeos is the first and only treatment approved by the FDA to treat an estimated 27,000 patients with RRP. The agency granted the drug full approval instead of waiting for a confirmatory study. In the single-arm trial supporting its application, 18 out of 35 patients responded well enough to avoid tumor removal surgery for at least 12 months after treatment with Papzimeos.

The agency and analysts following Precigen were encouraged by the fact that 15 out of the initial 18 responders remained surgery-free 24 months after treatment with Papzimeos. In response, Swayampakula Ramakanth from HC Wainwright reiterated a buy rating and an $8.50 price target that implies a 95% gain in the year ahead.

2. Mineralys Therapeutics

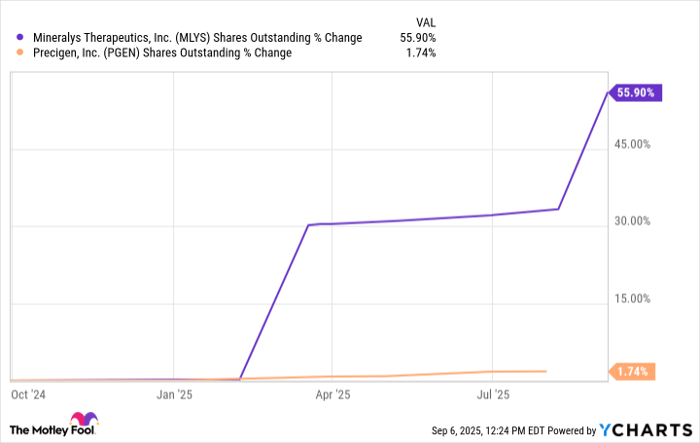

Shares of Mineralys Therapeutics rose 146% from the end of July through Sept. 5. Investors were excited about a successful new funding round to support continued development of lorundrostat, its lead candidate. On Sept. 2, Mineralys suspended an at-the-money equity offering and, within a couple of days, completed a secondary offering that ended up raising $287.5 million.

In August, investors hardly noticed a presentation of phase 3 trial results regarding lorundrostat. Patients who added the aldosterone inhibitor to the medications they were already taking reduced their systolic pressure by 16.9 millimeters of mercury after six weeks on treatment, compared to just 7.9 millimeters of mercury for patients who received a placebo.

Mineralys’ stock shot higher after AstraZeneca reported arguably inferior 12-week data for an aldosterone inhibitor it’s developing called baxdrostat. At week 12, it reduced patients’ systolic pressure by 15.7 millimeters of mercury, compared to 5.8 millimeters of mercury for the placebo group.

Less than a week ahead of Mineralys’ successful secondary stock offering, Bank of America analyst Greg Harrison boosted his target for the stock to $43 per share. The raised target implies a gain of about 24% from recent prices.

Time to buy?

Before you get too excited about Mineralys and its hypertension candidate, it’s important to realize the pre-commercial-stage business finished June with $325 million in cash, or enough to last into 2027. Diluting shareholder value to raise additional capital that could now push the stock price higher means the company isn’t super confident that it can quickly submit an application and earn approval for its lead candidate before the beginning of 2027.

MLYS Shares Outstanding data by YCharts.

At recent prices, Mineralys sports a huge $2.7 billion market cap that could shrink significantly if it looks like timing will become an issue that allows AstraZeneca’s candidate to gain and maintain a large share of the market for new hypertension drugs. It’s probably best to wait and see whether this company can earn approval for lorundrostat in a timely manner before adding the stock to your portfolio.

With a market cap of $1.3 billion at recent prices, expectations for Precigen are lower than they probably should be. Papzimeos is already approved and will launch unchallenged in its niche market.

Papzimeos’ addressable patient population is small, but a list price north of $200,000 per year per patient means it could rack up more than $1 billion in annual sales at its peak. Since drugmaker stocks generally trade at mid- to high-single-digit multiples of total sales, adding some shares to a diversified portfolio now looks like a smart move.

Should you invest $1,000 in Precigen right now?

Before you buy stock in Precigen, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Precigen wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $670,781!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,023,752!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 25, 2025

Bank of America is an advertising partner of Motley Fool Money. Cory Renauer has no position in any of the stocks mentioned. The Motley Fool recommends AstraZeneca Plc and Mineralys Therapeutics. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Healthcare #Stocks #Doubled #Soar #Higher #Wall #Street #Analysts