Key Points

Palantir Technologies (NASDAQ: PLTR) is one of the most popular artificial intelligence (AI) stocks in the market. It has been an absolute rocket ship and has more than doubled this year.

But it has had a rough couple of days and is off nearly 20% from its all-time highs. And one Wall Street analyst thinks it could tumble a lot further.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Rishi Jaluria of RBC Capital Management, a subsidiary of the Royal Bank of Canada, has a $45 price target on Palantir’s stock. So the stock still needs to tumble about 70% more to reach his price target. That’s a long way to fall for a proven AI leader, but is that a legitimate price target?

Image source: Getty Images.

Palantir’s product serves two major client bases

Palantir has become one of the leaders in practical deployment of AI. Its platform allows companies to take in huge data streams, process them, and present actionable insights to their users. It also has various tools to automate these processes through AI agents, making businesses far more efficient.

The company also has a unique advantage: Governments around the globe are significant customers. This stems from its original offerings, which were tailored for government use. Palantir eventually expanded to the commercial side, although its government business is still a huge part of the stock’s investment thesis.

In the second quarter, government revenue rose 49% to $553 million, while commercial revenue increased 47% to $451 million. Those are impressive results, and nearly any company would be happy with them. Palantir is also very profitable, converting 33% of its $1 billion in revenue into net income.

Clearly, the company is doing quite well right now. It has AI buildout tailwinds blowing in its favor and is rapidly growing its revenue profitably. It’s hard to imagine a scenario in which the stock plummets 70% from these levels, unless it is grossly overvalued — which it is.

Palantir has achieved a valuation few could imagine

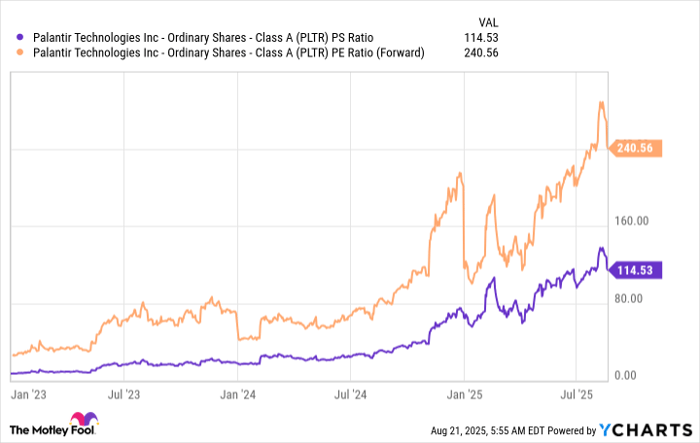

Palantir’s stock has been on a monstrous multiyear run. Since 2023, when the AI race kicked off, it is up over 2,300%. However, revenue has only risen 80% since then. That’s a huge mismatch and indicates that the stock’s valuation has dramatically expanded. At 115 times sales and 241 times forward earnings, this overvaluation thesis is confirmed.

PLTR PS Ratio data by YCharts; PS = price to sales, PE = price to earnings.

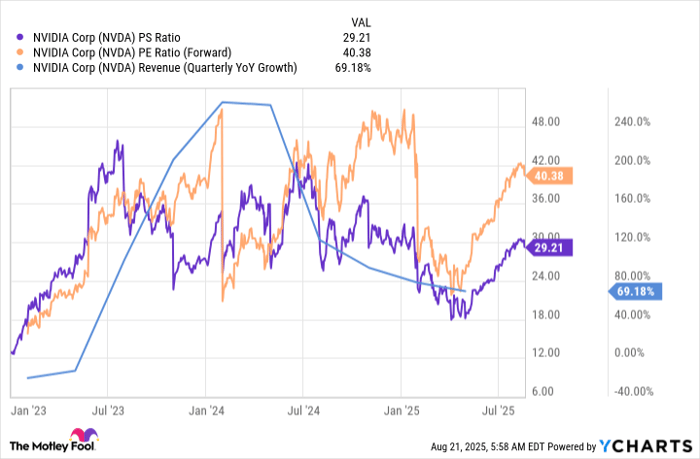

Although Palantir is growing rapidly, it’s not growing as fast as some might expect. Take Nvidia, for example. It has been the undisputed king of AI investing and even tripled its revenue year over year for a few quarters. Palantir isn’t anywhere close to that, yet it trades at much higher levels than Nvidia has ever experienced.

NVDA PS Ratio data by YCharts; YoY = year over year.

Nvidia never traded for more than 50 times sales or forward earnings during its run, which gives investors a pretty clear idea of where Palantir’s valuation should be.

If we apply a 50 forward earnings multiple to Palantir’s stock, that would indicate it should be worth 79% less than its current value. This makes Rishi Jaluria’s price target seem bullish. If we maxed out its price-to-sales ratio (P/S) at 30, which is still a very expensive price tag, the stock should be worth 74% less than it is today.

The reality is that years of growth are baked into the stock price, and it’s quite overvalued. While I would be surprised to see a 70% decline like Jaluria projects, the math supports that statement.

The market is forward-looking, though, and it sees a ton of success ahead for Palantir. I predict that it will rapidly grow as a company in the coming years; however, the market has already priced in all potential success and more, making the stock one to avoid until the price comes down to a more reasonable level.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $649,657!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,090,993!*

Now, it’s worth noting Stock Advisor’s total average return is 1,057% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 18, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Wall #Street #Analyst #Thinks #Palantir #Stock #Plummet