PhanuwatNandee

Introduction to the ProShares Ultra VIX Short-Term Futures ETF

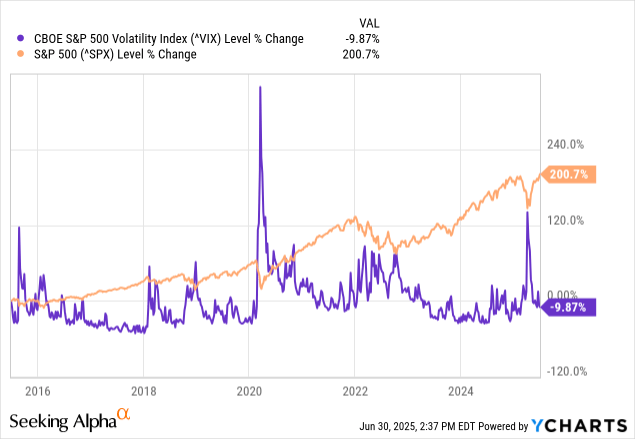

For many investors, the first time they are introduced to the concept of volatility is through the CBOE Volatility Index or “VIX”, a non-investible index that tracks the velocity of options in the S&P 500, essentially its “volatility level”, or as it was put best to me, a rough gauge of demand for S&P 500 put options (downside insurance).

See this link for details from CBOE itself on the VIX. They have a great 3-minute explainer video on it.

Naturally, this means that during sudden crashes or drops in the market that come out of nowhere, the VIX spikes sharply.

This phenomenon has meant that investors use VIX-related instruments as portfolio hedges, essentially betting on winning big during a black swan event.

Enter the ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY), which offers investors an investible fund that tracks not only the VIX but 1.5x the daily movement of the VIX.

The fund has over $600M in AUM and carries a 0.95% expense ratio.

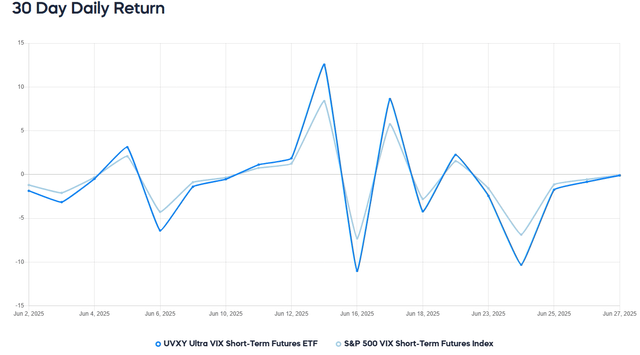

The leverage leads to exaggerations in price swings, which one can see very clearly in a short-term 30-day chart. The daily resetting nature of the fund makes it so that UVXY is unlikely to keep up 1.5x over longer timeframes, or even intraday.

ProShares

A Warning About Leverage

There are three warnings that I think investors should consider when looking at any daily-resetting leveraged fund:

1) The SEC notes:

Leveraged and inverse ETFs are typically designed to achieve their stated performance objectives on a daily basis. Some investors might invest in these ETFs with the expectation that the ETFs may meet their stated daily performance objectives over the long term as well. Investors should be aware that the performance of these ETFs over a period longer than one day can differ significantly from their stated daily performance objectives and may potentially expose investors to significant and sudden losses.

2) UVXY’s prospectus notes:

The use of leveraged... positions increases risk and could result in the total loss of an investor’s investment within a given day…

[UVXY is] intended to be used as a trading tool for short-term investment horizons, and investors holding shares of the Funds over longer-term periods may be subject to increased risk of loss…

For example, because the... Fund includes a one and one-half times (1.5x) multiplier, a single-day movement in the Index approaching 66.7% at any point in the day could result in the total loss or almost total loss of an investment in the Fund... This would be the case with downward single-day or intraday movements in the Index, even if the Index maintains a level greater than zero at all times and even if the Index subsequently moves in an opposite direction, eliminating all or a portion of the prior adverse movement…

3) This review of MSTX, the “Case Study For Bad Leveraged ETFs” can be viewed as a cautionary tale.

UVXY Performance

On the point in #2 from the last section, I wanted to see in VIX history if a 66.7% intraday drop has ever occurred, even before UXVY’s existence, just to see if there is a precedent for an event that could’ve blown up the fund.

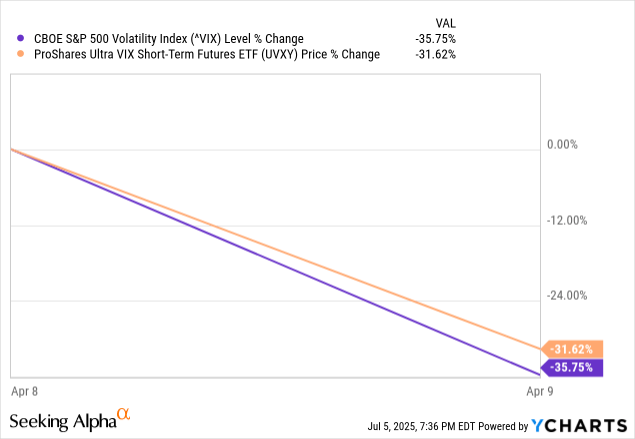

The record for the largest one-day VIX drop was set on April 9, 2025, when the S&P 500 spiked following Liberation Day tariff postponements. On that day, the VIX fell over 35%, and UVXY failed to meet its objective that day.

For the record, failing on that day ended up as a positive for shareholders, as the fund had some downside padding in the sudden drop, although it still fell over 30%. Much better than the expected 50%+ drop, assuming the 1.5x multiplier held through the drop.

This is an example of how the fund may deviate from its objectives, especially in extreme market conditions like those in April 2025.

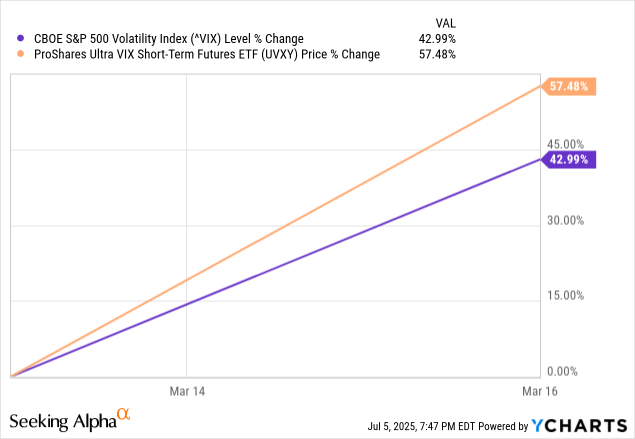

On the flip side, UVXY did get very close to achieving its objective on the dates of the largest one-day upward movement in the VIX, March 16, 2020. Note that this chart starts on the Friday before to show the full movement.

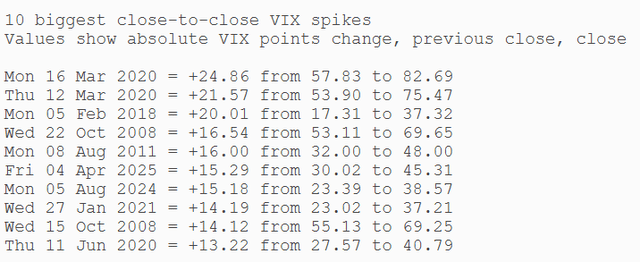

For those curious, here is a list of the various all-time largest one-day spikes in the VIX, if you want to compare how UVXY did on those dates to see how often it matches up to its objective.

MacroOption

Just note that the fund is variable in its performance and in meeting its objective, as the way it builds out the 1.5x exposure is complex and employs a very heavy use of derivatives.

UVXY Holdings

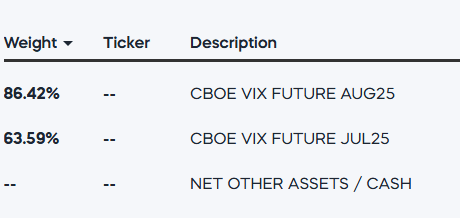

Futures are complex, and their intricacies are out of the scope of this article, but they are a necessary topic to cover because they are the entirety of the fund’s holdings.

ProShares

The industry term is “capital efficiency”, which is a word that the industry came up with to avoid “leverage”, but the idea with futures is that you can get more exposure to an asset than the capital you put up for the future. This allows the fund to spend 100% of its assets on futures and receive 150% exposure to the underlying asset of those futures, i.e., the VIX.

These futures are reset daily to ensure that UVXY keeps up its daily objective. Note that futures do not move linearly with the prices of their underlying assets, especially when volatility is heightened, and this dynamic creates the environment where UVXY may or may not achieve its objective on any given day. It’s not necessarily up to ProShares’ management, but how the futures market reacts to changes in the underlying asset.

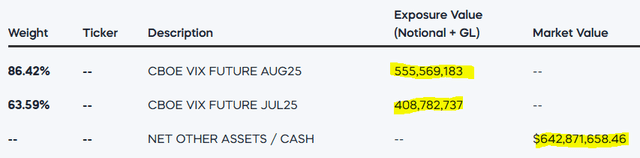

All of that is to explain why we see a market value of $642,871,658.46 on the holdings but a notional value of $964,351,920 when looking at the value of the futures contracts. Note that these are just example figures taken at one given moment in time, and the fund changes its positions daily.

ProShares

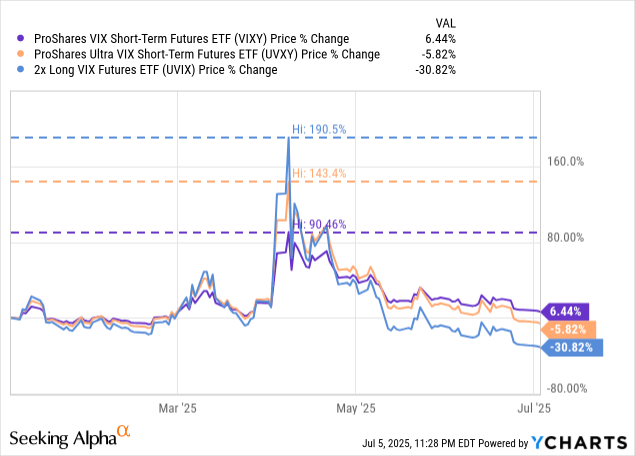

UVXY vs. Peers

There are multiple VIX-following and leveraged VIX funds on the market, and all of them operate similarly to UVXY by using futures to secure exposure to the VIX index.

| Ticker | Name | Leverage |

| VIXY |

ProShares VIX Short-Term Futures ETF |

1x |

| UVXY | ProShares Ultra VIX Short-Term Futures ETF | 1.5x |

| UVIX | 2x Long VIX Futures ETF | 2x |

Of course, these funds all move similarly over time, with the differences mostly being in the amount of leverage employed. Investors using VIX ETFs to hedge tend to skew toward the leverage so they can use less capital on the hedge, but that also adds more risk to the individual position. The trade-offs are up to the investor.

One thing we do note is that while all these funds tend to decay over time, as expected with a fund’s long volatility, the peaks they are able to hit during massive spikes in the VIX directly correlate to how much risk they pose.

UVXY Suitability

All of this begs the question: how do investors employ UVXY, and which investors could benefit from using it?

The way I see it, the fund is the most usable as a hedging tool since it tends to spike during market declines. It is also best used as a tactical tool that is brought in and out of a portfolio as needed to hedge market conditions. This may or may not be a hedge employed all the time since it tends to decay; however, it may be useful in that role if a strict rebalancing strategy, either timed or by bands, is employed with it.

Investors wanting to bet on rising volatility are able to take a “big swing with a small bet”, so to speak, using the leverage that UVXY offers. Caution is prudent here, as this is an alternative ETF that is not meant to be bought and held long term without another use or strategy attached to it.

Conclusion

Ultimately, investors wanting to protect their downside from sudden volatility could use the ProShares Ultra VIX Short-Term Futures ETF as a unique hedging tool, relying on its leverage and responsiveness to the VIX to offset sudden and steep losses in equities markets.

While this has historically been a profitable strategy, mistiming or poor position sizing could cause outsized losses for investors; caution is advised when approaching both alternatives, such as long volatility funds and leverage itself.

This is an ETF that investors should carefully consider and thoughtfully construct a strategy around, as it isn’t a “buy and hold” fund, per se.

Thanks for reading.

This article answers these three main questions about UVXY:

- Is UVXY a good tool for hedging an equity portfolio?

- Should investors expect to use a “buy and hold” strategy with UVXY?

- How much leverage does UVXY provide?

Editor’s note: This article is intended to provide a general overview of the ETF for educational purposes only and, unlike other articles on Seeking Alpha, does not offer an investment opinion about the ETF.

#UVXY #Leveraged #Volatility #Unique #Hedging #Tool #BATSUVXY