Key Points

-

Quantum computer companies have garnered investor interest, and this one shines as a top investment choice.

-

While quantum computing stocks have soared, other factors make Nvidia a standout among them.

-

Nvidia’s new quantum computing research center seeks to solve the issues inherent in quantum tech.

- 10 stocks we like better than Nvidia ›

Quantum computer companies have garnered investor interest, and this one shines as a top investment choice.

While quantum computing stocks have soared, other factors make Nvidia a standout among them.

Nvidia’s new quantum computing research center seeks to solve the issues inherent in quantum tech.

The hot field of quantum computing catapulted the stocks of several companies in the space. Examples include IonQ (NYSE: IONQ) and D-Wave Quantum (NYSE: QBTS). The former’s share price is up over 400% and the latter more than 1,000% in the last year through the week ending Aug. 29.

But of the businesses racing to produce quantum computers capable of adoption beyond research circles, Nvidia (NASDAQ: NVDA) stands out. Several factors contribute to its position as a top quantum computing stock to consider right now.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Why Nvidia is a compelling quantum computer stock

Nvidia is known as the artificial intelligence (AI) semiconductor chip leader. But as it looks toward the future, the company is working to evolve its tech for the quantum era. For example, it’s developing a core processing unit that works in a quantum computer.

In addition, Nvidia is opening a research center that will house “the most powerful hardware ever deployed for quantum computing applications,” according to the company. The center aims to solve challenges inherent in quantum devices, such as their propensity to make computational mistakes.

Beyond its tech, another factor making Nvidia a compelling quantum computer stock is the company’s outstanding financial health. While IonQ and D-Wave aren’t profitable, Nvidia’s net income was $26.4 billion in its fiscal second quarter (ended July 27), a 59% increase over the previous year. It also generated $13.5 billion in Q2 free cash flow, providing funds to invest in quantum technology.

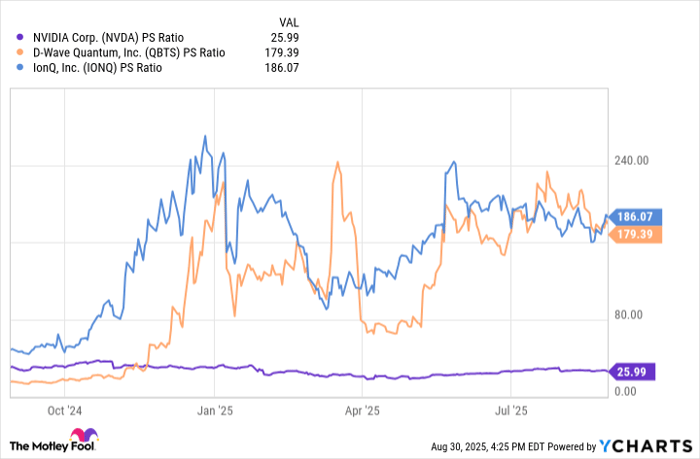

Moreover, Nvidia shares possess a superior valuation among quantum computer stocks such as IonQ and D-Wave. This can be seen in the price-to-sales (P/S) ratio of the companies.

Data by YCharts.

The chart shows that IonQ and D-Wave’s sales multiples skyrocketed over the last year, making Nvidia the lowest among the trio by a wide margin. This suggests IonQ and D-Wave stocks are overpriced.

With its better valuation, technological advancements, and strong financial standing, Nvidia emerges as an attractive investment in quantum computing.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $651,599!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,067,639!*

Now, it’s worth noting Stock Advisor’s total average return is 1,049% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 25, 2025

Robert Izquierdo has positions in IonQ and Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Quantum #Computing #Stocks #Buy