Alberfb/iStock via Getty Images

By Emily Balsamo and Eunice Son

At a Glance

- Around 40% of grains and oilseed options volume is now traded at 30 days-to-expiry or less.

- Weekly options can offer greater flexibility and more granular hedging opportunities, complementing standard, long-dated American options.

Agricultural derivatives are witnessing a structural shift in how participants manage risk, express a view and trade around key events in recent years. At the heart of this transformation is the growing popularity of weekly and short-dated options, as well as the increased prevalence of standard options traded with shorter days-to-expiry (DTE).

Short-Dated Options: A Structural Shift

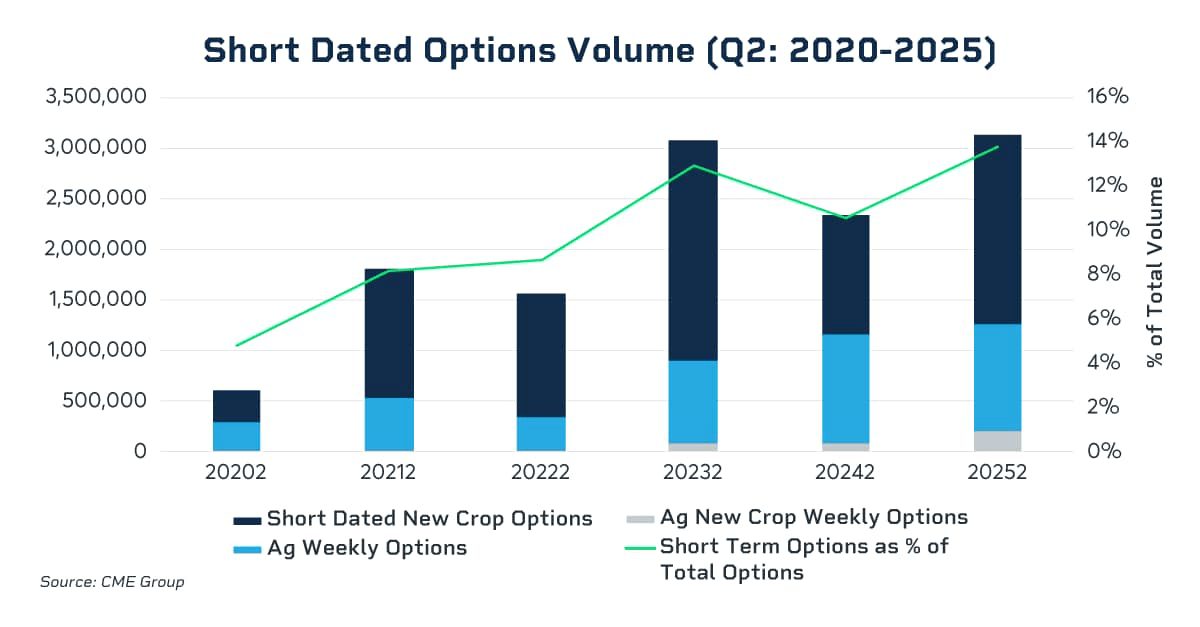

While Friday Weekly options have long provided shorter-term risk management opportunities, Weekday options on Corn, Soybean, Soybean Meal, Soybean Oil and Wheat futures that expire on Mondays, Tuesdays, Wednesdays and Thursdays were launched in February 2025, offering enhanced flexibility. In the grains and oilseed options complex, these shorter-term products have not only gained traction but now account for a significant share of overall trading volume. In Q2 2025, nearly 14% of grains and oilseed options volume was attributable to short-dated options, up from about 5% in the same quarter of 2020.

Short-Dated New Crop options (SDNCOs) have also gained a strong foothold in the grains and oilseed options space. SDNCOs, which are monthly options listed during the planting season and settling to November Soybean or December Corn futures, have increasingly become instruments of choice for market participants seeking precise, short-term risk management tools tailored to specific crop cycles and pricing windows. Along with New Crop Weekly options, SDNCOs allow more precise risk management tied to planting and harvest, USDA reports and weather events for new crop exposure. The popularity of SDNCOs underscores how options markets are evolving, not just in terms of volume but also in functionality and risk management.

Days to Expiration Trend Down

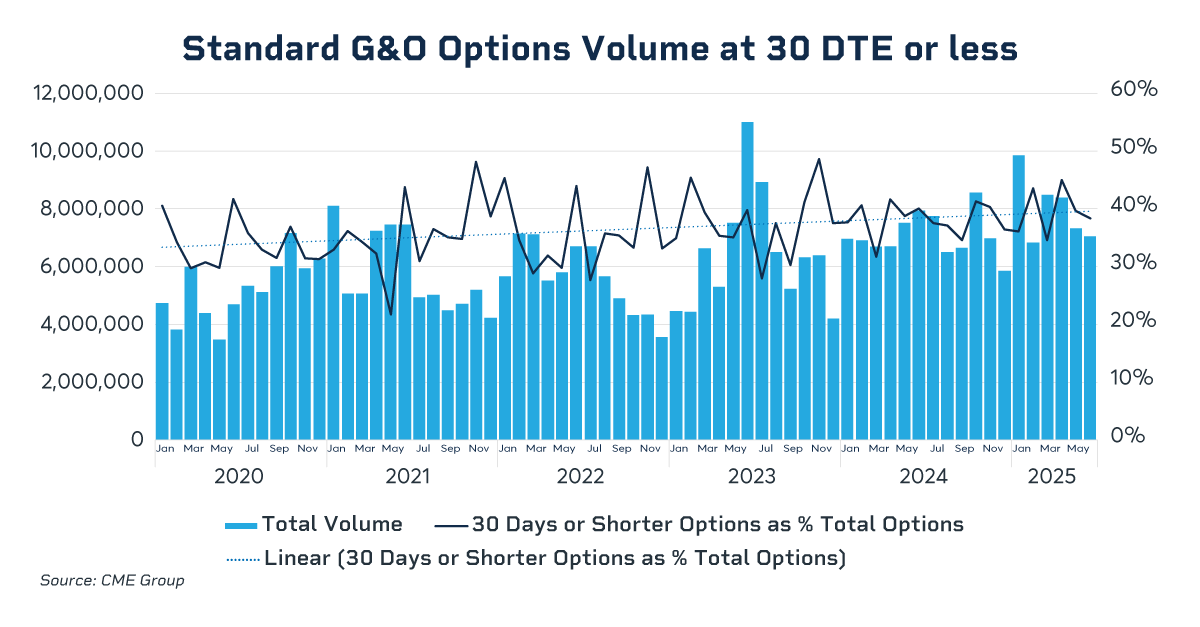

While options initially listed at short tenors have driven significant growth in grains and oilseed options volume in recent years, the complex has also seen a trend toward trading standard long-dated options at lower average DTE.

While Friday Weekly options on grains and oilseed futures are listed for only three consecutive weeks out (and Monday through Thursday options for only two), standard American options on grains and oilseed futures are listed for up to two years out. Although the listing cycles of standard American options allow for long-term exposure, there is an increase in trading activity with fewer days to expiration for these products as well, again speaking to the needs of market participants to manage short-term risk.

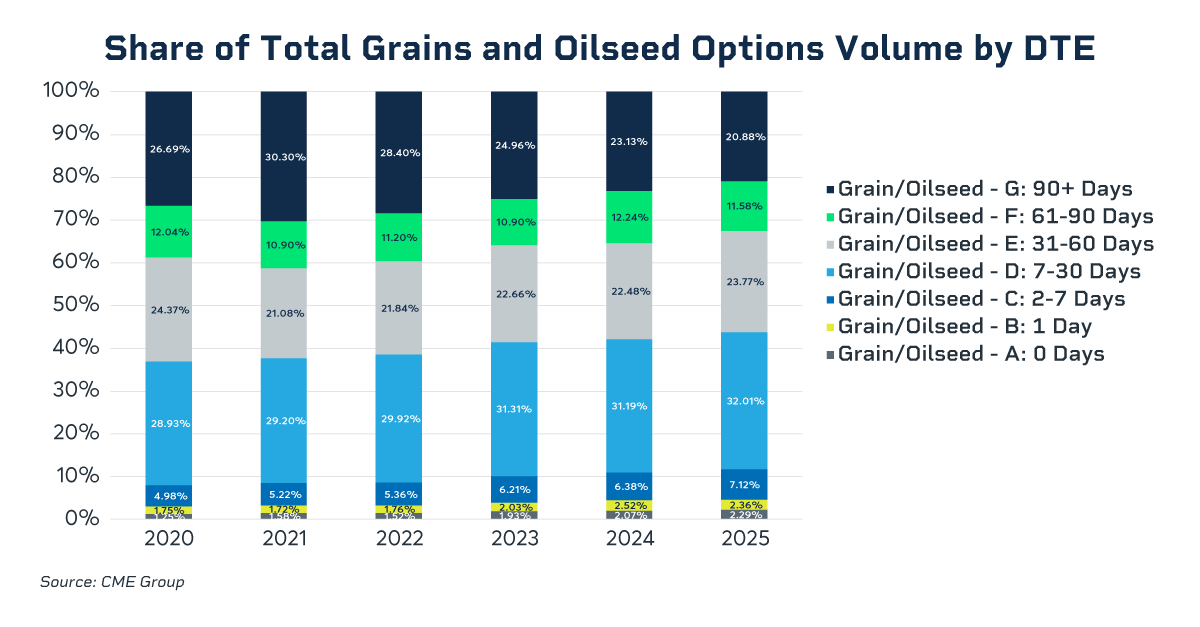

In the first half of 2025, options volume at 30 DTE or less made up over 40% of total volume. Within that range, the volume of options expiring between seven and 30 days is climbing, with shorter DTE trading – such as 0 day, 1 day, or 2-7 DTE volume – taking up a growing portion of the total volume in grains and oilseed options products. In 2020, nearly 27% of grains and oilseed options volume was traded at 90 or more DTE; in 2025, that share dropped to less than 21%, while the share of options trading at 0 DTE has nearly doubled, from 1.25% to 2.29% in that time.

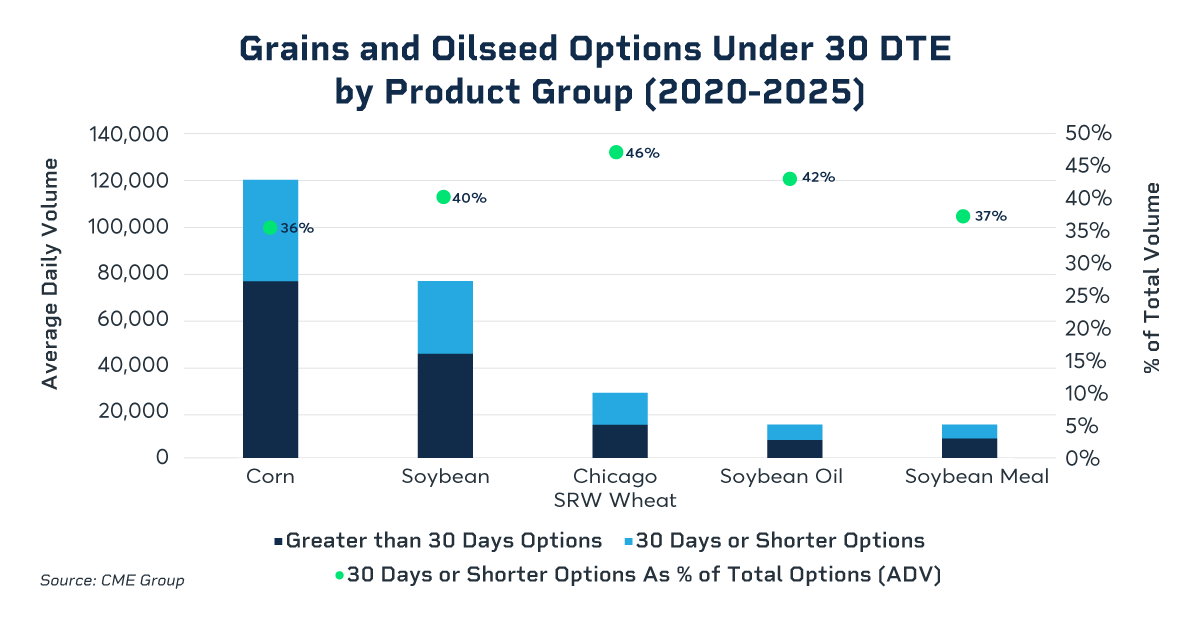

Since 2020, more than 36% of volume traded in options with an underlying Corn future has occurred at 30 DTE or less. Exceeding Corn’s share, 40% of total Soybean and Soybean Oil options volume has been traded at 30 DTE or less over that same period, with Chicago Wheat’s share exceeding 46%. The relatively high share of low-DTE volume within the Chicago Wheat options complex may reflect the needs of market participants to hedge supply-side geopolitical risk, while Soybean Oil may carry demand-side, short-term overnight risk due to changes in renewable fuel policy.

Offerings Respond to New Risk Management Needs

In an environment where supply chains are vulnerable to weather shocks, geopolitics and shifting trade policies, short-dated options and lower DTE strategies allow users to hedge around specific events. The rising popularity of weekly and short-dated options, coupled with the rising trend of trading longer-dated options at a lower average DTE, underscores a broader shift in market behavior.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#Grains #Oilseed #Options #Trending #Shorter #Term