Key Points

-

Oklo is a pre-revenue company developing advanced nuclear reactors.

-

Nuclear energy could play a key role in meeting AI-driven data center electricity demand.

-

A steady stream of catalysts has pushed Oklo’s stock price to an all-time high.

- 10 stocks we like better than Oklo ›

Oklo is a pre-revenue company developing advanced nuclear reactors.

Nuclear energy could play a key role in meeting AI-driven data center electricity demand.

A steady stream of catalysts has pushed Oklo’s stock price to an all-time high.

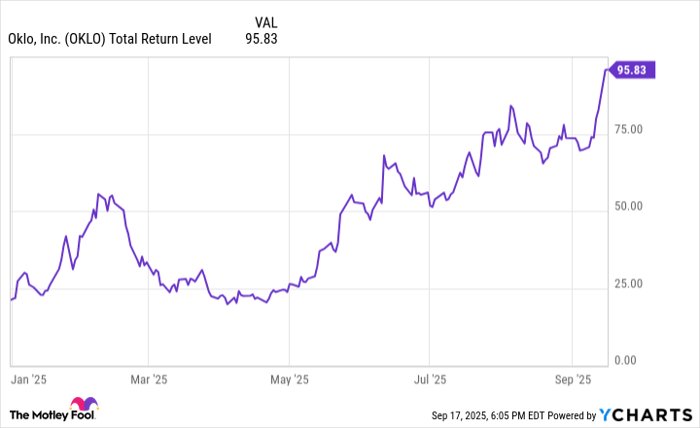

Oklo stock (NYSE: OKLO) is on some kind of run. As of Sept. 17, shares of the next-generation nuclear power company were up nearly 350% year to date, making mincemeat of the S&P 500‘s 12% gain. And Oklo has catapulted 1,400% higher over the past 12 months, without bringing in so much as a whiff of revenue.

Whenever it looks like Oklo might be drifting back down to earth, a new catalyst emerges — like Monday’s announcement that the U.K. and U.S. governments plan to fast-track the development of new nuclear power facilities in both countries, which pushed the stock price to an all-time high.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Oklo isn’t the only next-gen nuclear tech company surfing the wave of investor enthusiasm. Over the past 12 months, shares of NuScale Power and NANO Nuclear Energy have likewise surged 297% and 189%, respectively. Meanwhile, nuclear component supplier BWX Technologies is up 74%.

Why are investors so bullish on nuclear power — and Oklo in particular? There’s a perfect storm of catalysts driving interest in it, to be sure. But if you’re into the whole brevity thing, you could sum it up in two words: artificial intelligence.

Image source: Getty Images

AI is driving unprecedented energy demand

The rise of artificial intelligence (AI) systems has sparked a data center boom. The number of data centers in the United States skyrocketed from 1,000 in 2018 to more than 5,400 as of March 2025. Over the past five years, the number of hyperscale data centers — supersized facilities designed to handle massive computational workloads — has doubled, largely driven by demand for infrastructure capable of training and powering generative AI. Those numbers will continue to grow as AI rapidly evolves into a mainstream, all-purpose technology.

High-capacity data centers have nearly insatiable appetites for electricity. According to the International Energy Agency, a typical AI-focused data center consumes as much power as 100,000 homes. But the biggest ones being built today will demand 20 times as much. By 2030, global data center electricity consumption is expected to more than double to 945 terawatt-hours — roughly the equivalent of Japan’s total electricity usage today.

Without major upgrades to transmission, distribution, and generation capacity, the world’s aging power grid could become the AI revolution’s biggest bottleneck. The U.S. energy grid doesn’t have the excess capacity to produce nearly enough electricity to meet the projected power demand from domestic data centers over the next five years, according to McKinsey & Company. Elsewhere, countries like Ireland, the Netherlands, and Singapore have put many data center projects on hold due to a lack of power infrastructure.

That’s a big reason why the world is taking a fresh look at nuclear power. In late May, President Donald Trump issued a flurry of executive orders intended to turbocharge U.S. production of nuclear power, citing the “global race to dominate in artificial intelligence” and national security concerns. One of the major themes is faster deployment of advanced nuclear reactors, which would be a boon for Oklo. Its stock has more than doubled since Trump’s announcement.

OKLO Total Return Level data by YCharts.

According to Goldman Sachs Research, global nuclear energy capacity is expected to soar from its current level of 378 gigawatts to 575 gigawatts by 2040, fueled, in part, by increased investment in the type of next-gen reactors Oklo is developing.

Powering a new narrative

Global nuclear energy production plateaued in the wake of the 2011 Fukushima Daiichi accident in Japan, which renewed long-standing concerns about nuclear safety. However, next-gen nuclear companies like Oklo are shaping a new narrative that’s positioning nuclear power as a safe, reliable, and carbon-free alternative to fossil fuels.

Oklo is developing fast fission reactors that use nuclear waste as fuel and can go decades without refueling. These reactors — which Oklo calls “powerhouses” — don’t produce major air pollutants or greenhouse gases. Importantly, they’re modeled after an experimental reactor that’s designed to shut down safely in emergency situations, without operator intervention. Oklo claims the technology would keep reactors safe “during challenges as severe as those that led to the Fukushima accident.”

Since Trump issued his executive orders in May, Oklo has generated plenty of company-specific news to keep its stock price rocking. In July, it announced a partnership with Vertiv to co-develop advanced power and thermal management systems for hyperscale and colocation data centers, using steam and electricity from Oklo’s nuclear power plants.

Earlier this month, Oklo said it plans to build and operate a fuel recycling facility in Tennessee as part of a $1.7 billion advanced fuel center. The facility will recycle used nuclear fuel for fast reactors like Oklo’s Aurora powerhouse in Idaho, which is expected to begin operating by early 2028.

Nuclear energy is white-hot right now, and there appears to be no shortage of tailwinds for companies like Oklo. The Federal Reserve’s recently announced quarter-point interest rate cut could be another one. Lower interest rates generally reduce borrowing costs for companies, making it cheaper for them to finance large projects.

I’ve had Oklo stashed on my watch list for several months, waiting for a pullback that hasn’t come. If you’re a believer in advanced nuclear technology — and Oklo in particular — you might consider opening a small position in the stock now and scaling it up over time. Just keep in mind that it likely will be several years before Oklo generates any meaningful revenue, and there could come a day when the share price more accurately reflects the company’s fundamentals.

Should you invest $1,000 in Oklo right now?

Before you buy stock in Oklo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oklo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $651,345!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,080,327!*

Now, it’s worth noting Stock Advisor’s total average return is 1,058% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 15, 2025

Josh Cable has no position in any of the stocks mentioned. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Oklo #Stock #Year