Key Points

Sometimes, choosing the “best” stock or exchange-traded fund comes down to a matter of taste. Because they come in all sorts of colors and flavors, and there’s really something there for every palate. It’s like choosing a birthday cake — some people will want chocolate, some vanilla, and some may want a pie or ice cream cake. And there are no wrong answers.

To extend this to dividend ETFs, there are a lot of different ways you can go. You can look for a fund that is outperforming the index but skimps on dividend returns. You can find funds that offer fantastic returns but are trailing the market in overall performance.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Or you can be like me and find the middle ground. I’m choosing a great dividend ETF with a relatively low expense ratio, more-than-respectable year-to-date returns, and a healthy dividend yield. For me, the pick is the iShares Core High Dividend ETF (NYSEMKT: HDV).

Image source: Getty Images.

What is the iShares Core High Dividend ETF?

The HDV ETF is a passively managed fund operated by iShares, a subsidiary of Blackrock. The fund tracks 75 U.S.-based stocks in the Morningstar Dividend Yield Focus Index, with the goal of balancing yield, performance, and low costs. As fund managers rebalance the ETF quarterly, they look specifically for stocks that have sustainable dividends and strong balance sheets.

To that end, they do well. The iShares Core High Dividend ETF has a low expense ratio of only 0.08%, or $8 annually per $10,000 invested. Its dividend yield of 3.3% is comfortably higher than the 1.2% yield of the S&P 500. And its year-to-date gain of 9.1% is on par with the overall market — and better than you’ll see in several other dividend ETFs.

What stocks do you buy with the HDV ETF?

Buying shares of the iShares Core High Dividend ETF gets you a who’s who of blue-chip dividend stocks. Nearly 20% of the fund is in financial services stocks, but you also have a healthy representation of tech stocks (16%), healthcare (12.4%), and communications (11.3%). The fund’s top holdings include ExxonMobil, Johnson & Johnson, AbbVie, Chevron, and Home Depot.

| Equity | Portfolio Weight | Dividend Yield |

|---|---|---|

| ExxonMobil | 8.7% | 3.5% |

| Johnson & Johnson | 6.7% | 2.9% |

| AbbVie | 6% | 3.1% |

| Chevron | 5.9% | 4.3% |

| Home Depot | 4.7% | 2.2% |

Sources: Morningstar, Yahoo! Finance. https://www.morningstar.com/etfs/arcx/hdv/portfolio

For me, the diversification and blue-chip names are a major selling point when I’m looking for dividend ETFs. You can find some with a bigger payout ratio, such as the Alerian MLP ETF, which tracks master limited partnerships and offers an 8% yield. But the downside is that you are heavily dependent on energy stocks, and I’m never a fan of being overly exposed to any one sector. It should also be noted that the Alerian MLP ETF is trailing the market so far this year despite that oversized yield.

Stacking the iShares Core High Dividend ETF against the competition

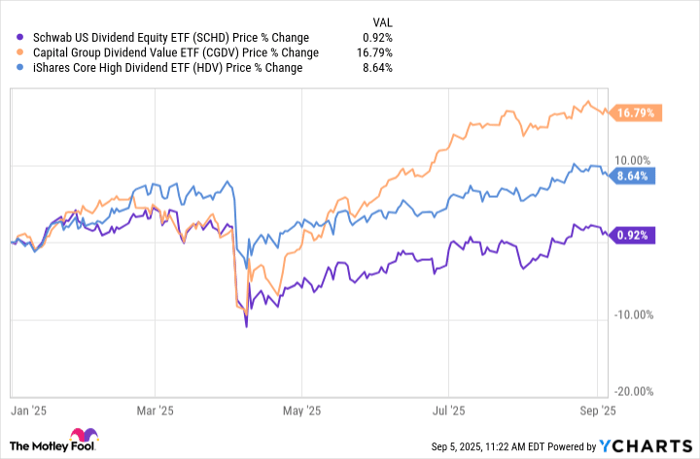

Let’s look at the HDV ETF in a head-to-head comparison with two other popular dividend ETFS — the Schwab US Dividend Equity ETF and the Capital Group Dividend Value ETF.

SCHD data by YCharts

Here you have three distinct flavors of funds. The Capital Group Dividend Value ETF is by far having the best year if you look strictly at the returns, but that’s because it’s overloaded with technology stocks that pay a low dividend. Top holdings include Microsoft, which yields 0.6%, and Nvidia, which yields a paltry 0.2%.

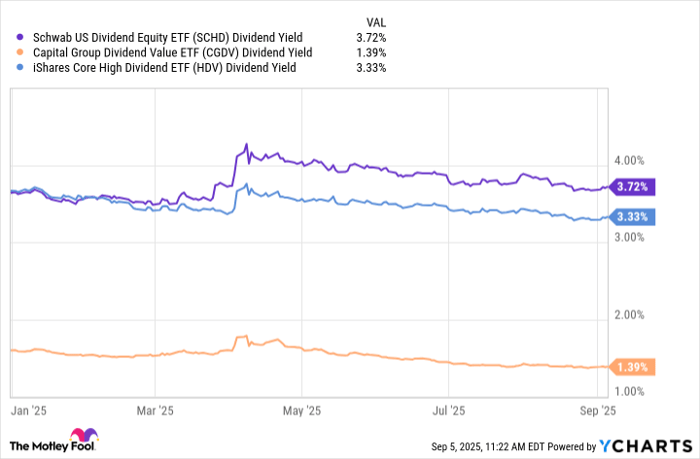

On the other hand, there’s the Schwab US Dividend Equity ETF, which has a slightly superior yield to the iShares Core High Dividend ETF, but its year-to-date performance is subpar.

SCHD Dividend Yield data by YCharts

That’s why I’m partial to the iShares offering here. I appreciate the blue-chip names and the balance of performance to yield. ETFs such as this are an outstanding way to diversify a portfolio, and it’s even better if you can find one that actually pays you back to hold it.

If you take a position in this or any other dividend ETF, an excellent idea is to make sure you reinvest your quarterly dividend payout back into the fund to allow your earnings to compound over time. By keeping a diversified, well-rounded portfolio of dividend stocks, you’ll be well on your way to meeting your retirement goals.

Should you invest $1,000 in iShares Trust – iShares Core High Dividend ETF right now?

Before you buy stock in iShares Trust – iShares Core High Dividend ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust – iShares Core High Dividend ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $671,288!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,031,659!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of September 8, 2025

Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie, Chevron, and Home Depot. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Dividend #ETF #Perfectly #Balanced #Yield #Growth