Key Points

-

Nvidia believes data center infrastructure spending will rise to $3 trillion to $4 trillion by 2030.

-

Even if Nvidia can succeed in reaching the $1 trillion milestone, two companies could beat it to the punch.

- 10 stocks we like better than Nvidia ›

Nvidia believes data center infrastructure spending will rise to $3 trillion to $4 trillion by 2030.

Even if Nvidia can succeed in reaching the $1 trillion milestone, two companies could beat it to the punch.

Nvidia (NASDAQ: NVDA) CEO and co-founder Jensen Huang made some jaw-dropping claims during the company’s Q2 earnings call. Chief among them was the projection that a $3 trillion to $4 trillion artificial intelligence (AI) infrastructure opportunity will emerge by 2030. Considering the top four AI hyperscalers are spending about $600 billion annually, according to Huang, that’s a massive increase for the remainder of this decade.

Nvidia captures a significant portion of that spending with the company generating $147 billion in data center revenue over the past four quarters. That figure should clear $182 billion for fiscal 2026, so as much as three out of every 10 spent by the top AI hyperscalers is allocated to Nvidia’s hardware.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Even on the low end of Nvidia’s guidance range, it could approach $1 trillion in revenue by 2030 if its share of AI spending holds (or increases). While no companies currently generate $1 trillion in revenue, there are several that are far closer to the $1 trillion mark than Nvidia. Can it be the first?

Image source: Getty Images.

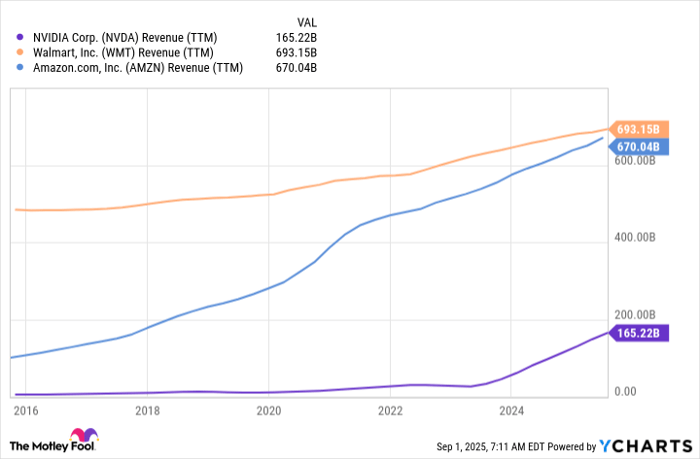

Amazon and Walmart have a huge lead over Nvidia

The market leaders in revenue generation are retail companies that sell a massive amount of products but with thin margins on each sale. This places retailers like Walmart and Amazon at the top of this list with both having a significant lead over their competitors.

Data by YCharts.

However, neither Amazon nor Walmart is growing nearly as fast as Nvidia.

Based on each company’s revenue growth in their most recently reported quarters (13% for Amazon and 5% for Walmart), Amazon would cross the $1 trillion milestone in just over three years, while Walmart would reach it in year seven. So, Nvidia may be beaten to the punch by Amazon, but it could still catch up to Walmart if Huang’s projections prove accurate.

Nvidia’s $1 trillion projection is incredibly optimistic

Before you get too carried away by this possibility, there is no guarantee the rest of this decade plays out as described above. Keep in mind that for Nvidia to reach $1 trillion in revenue by the end of 2030, it would need to record a compound annual growth rate (CAGR) of 39%. That’s a high growth rate for any company, let alone the world’s largest. Still, Nvidia did report 56% revenue growth in its fiscal 2026 second quarter, despite restrictions for GPU sales to China, a situation that could resolve itself soon.

The only way Nvidia can sustain this growth rate is if the massive investments from AI hyperscalers pan out, while overall demand for AI expands. But at the same time, none of the AI hyperscalers are growing that quickly, and it would require these companies to allocate nearly all of their cash flows to AI. If they don’t see a payoff from their investments, they may not be inclined to grow their spending over time.

Given the current state of AI deployment, it’s impossible to predict where the technology will be in 2030. The most likely result lies somewhere between Nvidia’s bullish projection and where the industry stands today, which can still mean continued success for the chip giant. While I’m not convinced Nvidia will generate $1 trillion in revenue by 2030, I do believe it will remain a market-beating stock over the next five years, making it a solid buy.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $670,781!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,023,752!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 185% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of August 25, 2025

Keithen Drury has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Amazon, Nvidia, and Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

#Nvidia #Company #Generate #Trillion #Annual #Revenue #CEO #Jensen #Huang #Shares #Bold #Projections