UBS Global Wealth Management has lowered its year-end S&P 500 target to 6,400, joining other Wall Street firms like Barclays and Goldman Sachs in reducing expectations due to the potential economic impact of US tariffs.

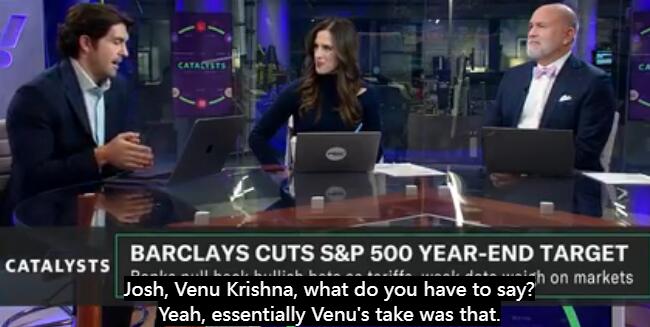

UBS Global Wealth Management (UBS) has adjusted its S&P 500 (^GSPC) year-end 2025 target downward to 6,400 from 6,600, echoing similar moves by other major financial institutions like Barclays and Goldman Sachs. This revision reflects growing concerns about the potential economic fallout from U.S. tariffs, particularly those imposed by former President Donald Trump.

Despite maintaining an “attractive” outlook on U.S. equities, UBS also reduced its 2025 earnings per share (EPS) estimate for the S&P 500 to $265 from $270. UBS strategists cited the “policy uncertainty shock” as a key factor, anticipating further weakness in economic and corporate profit data in the coming weeks. This could lead to continued volatility in U.S. equity markets in the short term.

The strategists noted that tariffs imposed by Donald Trump on key trading partners, including the recent 25% levy on auto imports, have unsettled global financial markets. The S&P 500 has already fallen over 4% this year, even entering correction territory in March.

Despite the downward revision, UBS remains optimistic about a potential rebound in U.S. equities by the end of the year. This optimism hinges on factors such as increased policy clarity, sustained economic growth, and continued investment in artificial intelligence (AI). The brokerage’s current index target is still 12% higher than the last close of 5,693.31.

UBS identifies information technology as the “most attractive” sector within the index, anticipating substantial growth driven by AI investments. Earlier this month, Barclays, Goldman Sachs, and RBC also lowered their S&P 500 index targets, citing the uncertainty surrounding tariffs as a primary concern.