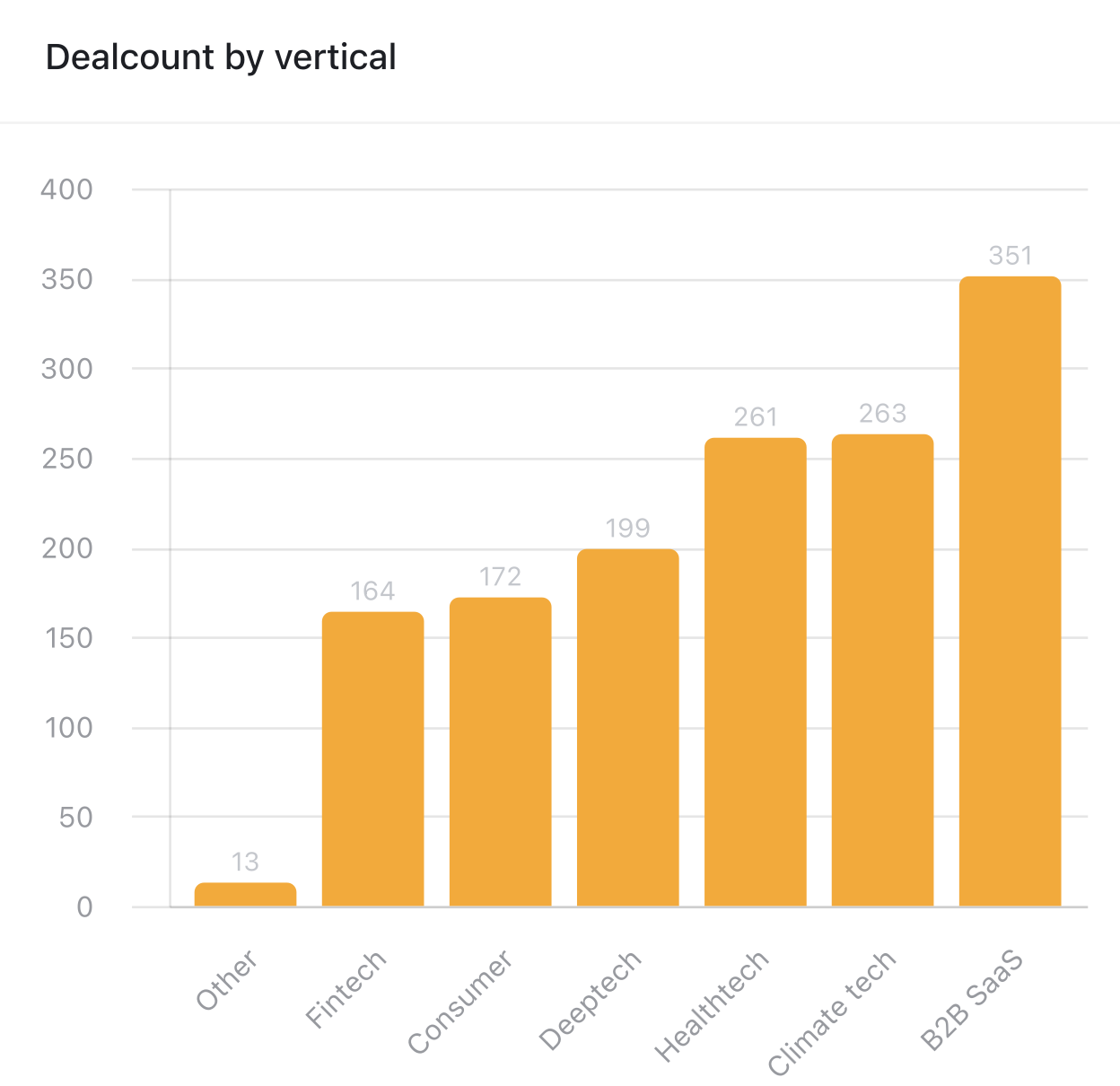

Dealmaking in the fintech sector has lagged behind sectors it once bested in terms of deal count and funding so far this year. There have been only 164 deals in Europe’s fintech sector, less than half the 353 deals in the B2B Software-as-a-service vertical according to data collected by Sifted.

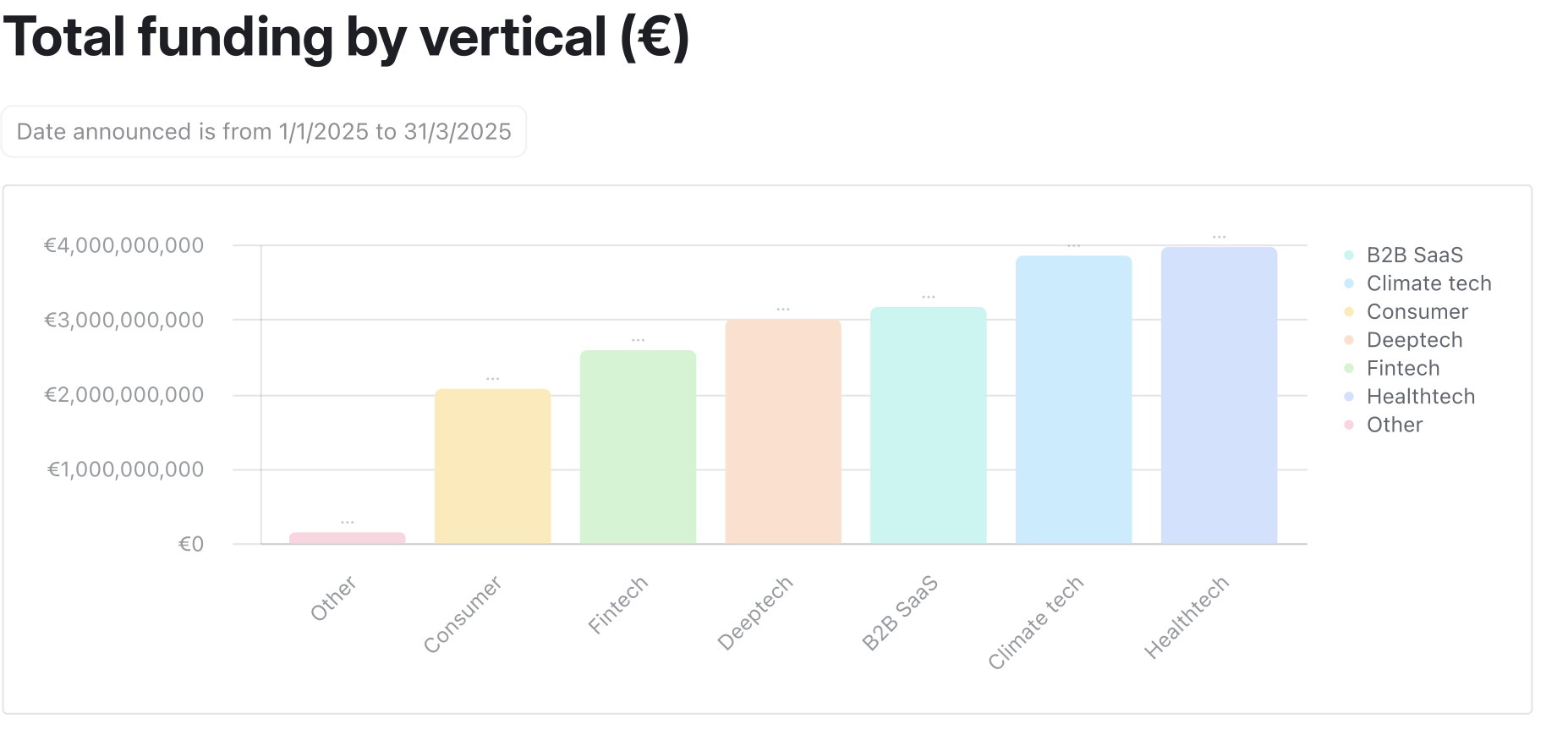

Fintech didn’t fare much better in terms of total funding either. Europe’s fintechs raised close to €2.6bn in the sector across equity and debt deals compared to the close to €4bn that went to healthtech startups, which was Europe’s top vertical by total funding last quarter. The worst-performing sector was startups focused on the consumer sector, which only raised €2bn in the first quarter of this year.

That’s compared to the first quarter of last year when European fintech raised €3.4bn across 202 deals across the sector. Only climatetech raised more at a mammoth €16.6bn thanks to debt rounds from the likes of Northvolt, Stegra and Enpal.

The fall in deal count and funding for fintech comes as many of its larger players hit profitability and forgo raising primary funding to opt for secondary share sales. Smaller fintechs are also no longer raising at the funding round sizes and valuations of the pre-2021 period as investor hype focuses on the buzzy du jour sectors such as AI, climate tech and healthtech.

That’s not to say there aren’t any bright spots, however. In fintech, crypto, payments and wealthtech were the most active subsectors by deal count, with startups in those sectors closing 93 deals between them — more than half of the 164 deals in the quarter.

In terms of funding, however, digital lending took the top spot among fintech verticals with €1.1bn raised. Digital banking came second with €391m raised, closely followed by crypto startups with €370m.

#Europes #investors #shun #fintech #deals #B2B #SaaS #healthtech