kasinv/iStock via Getty Images

Wall Street Versus Main Street

President Trump’s promises during the presidential campaign became a reality surprising equity market participants judging from the stock market’s reaction to his tariff announcement on April 2nd. In the lead up to last year’s November election on the campaign trail, Donald Trump was clear he was going to pursue a tariff strategy as a main policy goal in dealing with, in his view, unfair trade practices. Investors are learning that President Trump is following through on campaign promises.

As we wrote in a report to clients the day after the Rose Garden tariff announcement, the market’s negative reaction seems related to the fact the size of the tariffs announced by the President surprised most investors. Further, the calculation of the reciprocal tariff rate applied to respective countries seems focused on trade imbalances versus tariff imbalances. This has created uncertainty around the impact to the global economy and inflation; thus, might this action tip the economy into a recession?

The trade deficit issue is clearly seen in the near chart. The U.S. monthly trade deficit has increased to -$122.7 billion as of the February 2025 report. According to U.S. Census Bureau data, once China was granted most favored nation status imports from China doubled from 1996 to 2001 and continued to widen after China’s entrance into the World Trade Organization in 2001. The deficit then accelerated further following the Covid recession. Many U.S. industries have been harmed by China’s trade activity. The U.S. is less impacted by trade tariffs as we only export about 11% of our GDP output, which is about the lowest export level of any country. The U.S. consumer’s voracious appetite for goods is a significant factor in contributing to this imbalance. Additionally, there is an opportunity for the U.S. to garner a larger share of the world’s trade.

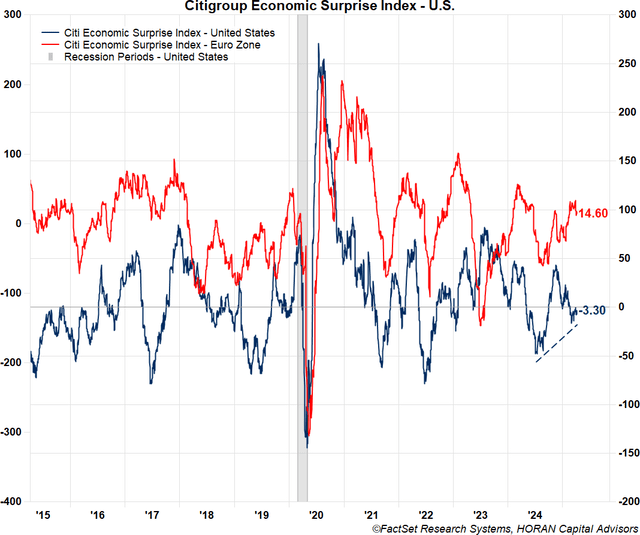

As it pertains to the U.S. economy, much of the hard data is not suggesting we are near falling into a recession. Employment continues to be strong as nonfarm payrolls reported on April 4th showed payrolls increased 228,000 which was better than the consensus expectation of 130,000. Broadly, the Citigroup Economic Surprise Index for the United States is showing a smaller number of economic reports that are deviating from expectations as the surprise number for the U.S. is becoming less negative. The red line on the near chart represents the surprise index for the Euro Zone and it is at a solid 14.6, indicating economic data in the Euro Zone is being reported above expectations.

Currently, the U.S. economy appears to be growing, albeit at a slow pace. One factor that can reverse this growth economic environment is sentiment and confidence. Reduced confidence at both the consumer and business level can also contribute to the economy slowing and falling into a recession. A recent decline in confidence is evident based on surveys, but the hard economic data is not supporting the weaker confidence level at this time. If consumers are reluctant to spend and businesses pull back on capital expenditures or expansion plans because of the uncertainty surrounding tariffs, this could tilt the economy in the direction of a recession as economic activity slows.

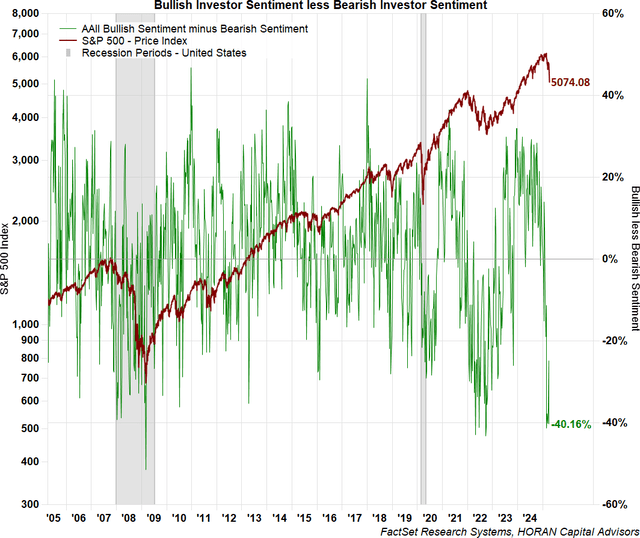

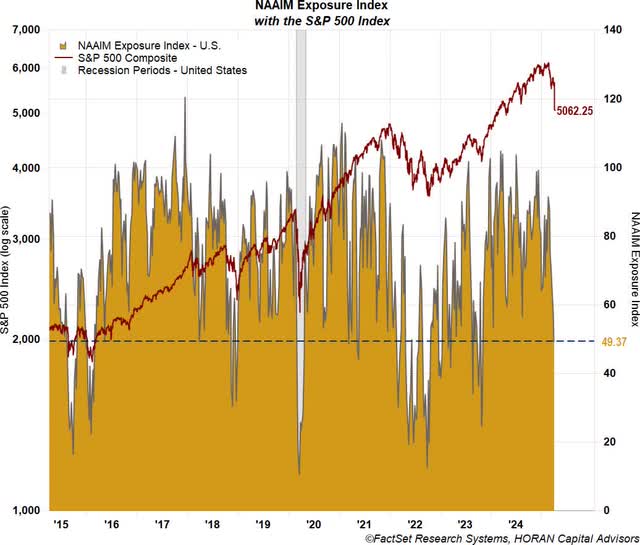

Weak sentiment is also showing in investor sentiment surveys. The American Association of Individual Investors is showing a high level of bearishness for individual investors. The near chart displays the difference between the weekly reading for bullishness and bearishness. The current spread is a wide -40.16%. On the institutional side, the National Association of Active Investment Managers (NAAIM) survey its member firms who are active money managers and are asked each Wednesday to provide a number which represents their overall equity exposure at the market close. Responses can vary from -200% short to 200% Leveraged Long. The current reading of 49.37% shows firms are not fully long equity exposure.

First Quarter 2025

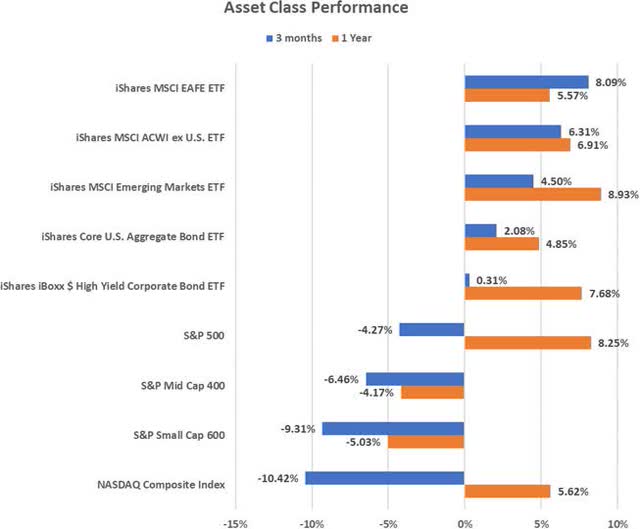

The end of the first quarter on March 31st seems like it is a distant past given the previously noted tariff issues that unfolded at the start of April. Nonetheless, some interesting performance metrics were taking shape in the first quarter that had an impact on an investor’s returns in a diversified portfolio. As noted on the asset class return chart, the first three months of this year had international markets outperforming the U.S. market. In the quarter, developed international or the MSCI EAFE Index ETF (EFA) was up 8.09% compared to the S&P 500 Index return of -4.27%. One of the weaker returning indexes was the NASDAQ Composite down -10.42%. Contributing to the NASDAQ decline was the weakness in the so-called Magnificent 7 stocks, with the Mag 7 ETF (MAGS) down -14.37% in the first quarter. The other 473 stocks in the S&P 500 were actually up 1.04% in the quarter. Since the Rose Garden tariff announcement though, the Magnificent 7 stocks are down about an additional nine percentage points and the other 473 stocks are down similarly.

Conclusion

As investors have seen over the recent trading days, uncertainty tends to amplify volatility. Indeed, the VIX, or Wall Street’s fear gauge, has climbed to levels commensurate with levels seen during COVID and the last round of tariffs during 2018. In a period of heightened volatility, the market may react less on fundamentals but instead it channels the panic-driven momentum into a downward market. However, this volatile environment may allow investors the opportunity to upgrade the quality of their portfolio. Additionally, as seen in the previous paragraph, choppy market periods remind investors the importance of diversified investment assets within a portfolio.

Under these market conditions the future is hazy, NYU professor Aswath Damodaran certainly seems to agree: “Anyone who tells you that their crystal balls, data or charts can predict what’s coming is lying or delusional, and there is no one right response to this (or any other) crisis.” So, investors need ask themselves what their appropriate response should be when markets lose ground. One important action is to evaluate and assess one’s comfort level with the current asset allocation in their portfolio. At the moment, does the portfolio maintain investments that hold up better in the down-market period that are accessible to maintain ongoing spending needs. When the market recovers an investor should then adjust their portfolio allocation between more risky versus less risky investments based on one’s reaction to the volatile period. Over time the equity market’s direction is higher with bouts of pullbacks along the way. This period of volatility shall pass once the uncertainty is better understood or eliminated.

Thank you for your continued confidence and support in HORAN Capital Advisors and we are always available to answer your questions and discuss our outlook further. Please be sure to visit us for company news, reports, and our blog at https://horanwealth.com/insights.

Respectfully,

HORAN Capital Advisors

|

HORAN Capital Advisors, LLC is an SEC Registered Investment Advisor. The information herein has been obtained from sources believed to be reliable, but we cannot assure its accuracy or completeness. Neither the information nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. Any reference to past performance is not to be implied or construed as a guarantee of future results. Market conditions can vary widely over time and there is always the potential of losing money when investing in securities. HCA and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. For further information about HORAN Capital Advisors, LLC, please see our Client Relationship Summary at IAPD – Investment Adviser Public Disclosure – Homepage. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

#HORAN #Capital #Advisors #Spring #Quarterly #Investor #Letter