Increasing movement of homeowners insurance risk to the U.S. surplus lines market has continued to contribute to growth for nonadmitted insurers.

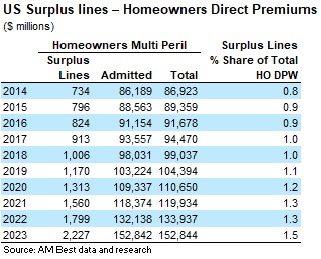

According to a report from AM Best, surplus homeowners direct premiums written in 2023 eclipsed $2 billion for the first time to increase its share of the total property/casualty homeowners DPW to 1.5%—the highest percentage in a decade as volatility in underwriting results for admitted carriers has resulted in increased rates for property insurance.

U.S. admitted carriers are turning away from property lines, which have seen higher loss activity, higher reinsurance costs, and retentions of risk, which are all driving premium dollars into the E&S segment. When the industry rating agency aggregates 2024 surplus lines data, AM Best said it expects the trend of growth will continue. In fact, the U.S. has been a notable contributor to the topline of many London market companies.

The special report, “Challenging Market Conditions Yield Opportunities for Surplus Lines Insurers,” released April 22, said nonadmitted insurers “have had the flexibility to meet demand during tough market times,” leading to an increase in U.S. homeowners surplus premiums to $2.2 billion in 2023 from $1 billion in 2018.

The special report, “Challenging Market Conditions Yield Opportunities for Surplus Lines Insurers,” released April 22, said nonadmitted insurers “have had the flexibility to meet demand during tough market times,” leading to an increase in U.S. homeowners surplus premiums to $2.2 billion in 2023 from $1 billion in 2018.

The direct premiums written in residential, homeowners and other personal property grew 41% from 2022 to 2024 to make up 4.9% of the total U.S. surplus lines market.

Overall, liability (including general, aviation, and products) and commercial property made up 36.9% and 32.9% of surplus lines premiums, respectively, according to data from the 15 U.S. surplus stamping offices nationwide. From 2022-2024, premiums from these stamping offices increased 28.8% to about $81.6 billion.

California, Florida, Texas, and New York produced more than 75% of the total U.S. surplus DPW in 2024.

The rating agency singled out California, whose personal and commercial property insurers have dealt with unfavorable results even before this year’s wildfires. Some admitted insurers adjusted their books of business and pushed more premium to the surplus lines market.

“The California property market is likely to face more challenges in the near term, and surplus lines’ insurers could look to fill supply gaps as more admitted insurers become reluctant to provide market capacity in areas of the state,” said David Blades, associate director at AM Best.

Topics

USA

Excess Surplus

Homeowners

Interested in Excess Surplus?

Get automatic alerts for this topic.

#Increased #Writings #Homeowners #Adds #Surplus #Lines #Growth