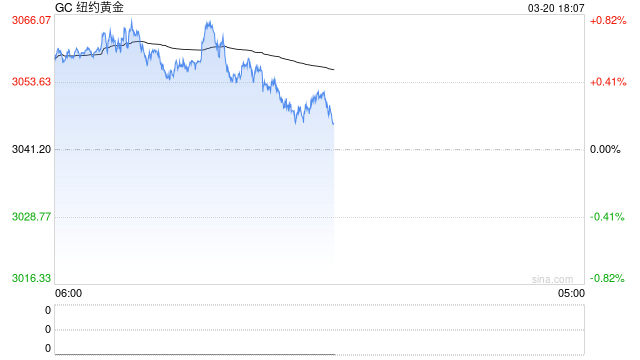

On March 19th, COMEX gold continued to rise in the late trading session, closing at $3057.5 per ounce, an increase of 0.55%. Domestic SHFE experienced high volatility during the night trading session, closing at 705.76 yuan/gram, an increase of 0.16%.

On Wednesday, March 20th Eastern Time, the Federal Reserve announced after its monetary policy committee FOMC meeting that the target range for the federal funds rate would remain unchanged at 4.25% to 4.5%. This is the second consecutive monetary policy meeting of the Federal Reserve that has decided to suspend interest rate cuts. At the same time, the Federal Reserve announced that it will slow down the pace of reducing its balance sheet from next month. This is the first time the Federal Reserve has adjusted its balance sheet reduction since June last year.

The interest rate forecast matrix released by the Federal Reserve after this meeting shows that Fed officials, like at the end of last year, still expect two interest rate cuts this year. However, the Fed has lowered its GDP growth expectations and raised its inflation and unemployment expectations, reflecting their expectations of the impact of Trump’s policies on the economy and inflation. According to tools from CME, the market expects a 99% probability that the Federal Reserve will keep interest rates unchanged this week, a probability of over 84% that it will not cut rates in May, and a probability of nearly 75% that it will cut rates in June. Against the backdrop of stronger expectations of interest rate cuts in June, the US dollar has slightly declined, while gold prices continue to rebound, and the strong pattern is expected to continue.

Geographically, Trump stated that his conversation with Zelensky was “productive”. Russian officials say they cannot rule out the possibility of Putin and Trump meeting in Saudi Arabia. In fact, Russia’s numerous demands reflect the huge differences between Russia and Ukraine on the ceasefire issue, and it is difficult to achieve substantial breakthroughs in the short term. The safe haven nature of gold still supports the price of gold, but caution should be exercised against the risk of a pullback caused by profit taking after breaking through new highs.