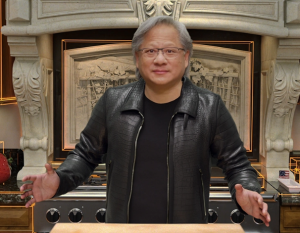

Nvidia shares fell over 2% early Friday, positioning the stock for a weekly decline exceeding 4%. This drop follows CEO Jensen Huang’s keynote on Tuesday, which failed to reignite the bullish sentiment investors were hoping for to revive enthusiasm around artificial intelligence. The stock has already slipped 13% since the beginning of the year. Notably, on Thursday, Nvidia’s 50-day moving average fell below its 200-day average — a bearish technical signal known as a “death cross,” last seen in April 2022, after which the stock plunged over 30% in two months.

“There’s a lot of downside pressure,” remarked Larry Tentarelli, founder and chief technical strategist at Blue Chip Daily Trend Report. “The technical setup on Nvidia is particularly challenging right now.”

Investor caution has been heightened by concerns over AI spending, especially following developments from China’s DeepSeek, and a clouded macroeconomic outlook, with renewed worries about trade and tariffs sparked by former President Donald Trump’s rhetoric. These uncertainties have dragged down Nvidia and other major tech giants, with the index tracking the “Magnificent Seven” down over 15% year-to-date.

All this comes despite Nvidia maintaining strong fundamentals and boasting one of the lowest price-to-earnings ratios it has seen in years. Still, investors appear to be waiting for more concrete signs that the company’s optimistic revenue projections — including a potential Q1 revenue surge to $43 billion — will materialize.

In the broader AI sector, investors seem to be pressing pause, waiting for more tangible returns to justify continued heavy investment. Such clarity could help lift confidence across the sector, especially for other large-cap tech stocks that have recently been hit hard.

“What we’re seeing reflected in Nvidia’s price action is broader economic anxiety and apprehension over DeepSeek,” Tentarelli added. He warned that any signal from major cloud players that AI spending may be reduced could trigger more selling pressure for semiconductor stocks.

Adding to Nvidia’s current challenge is the lack of near-term positive catalysts post-GTC. With few immediate events to drive sentiment, the broader economic picture becomes all the more crucial.

Richard Ross, head of technical analysis at Evercore ISI, suggested investors keep an eye on April 2 — the date Trump has indicated his team might impose new reciprocal tariffs — as a pivotal moment. Ross, however, is less concerned about the death cross itself, noting that Nvidia’s recent sideways trading weakens the predictive power of such technical patterns.