While GDP forecasts are being revised downward, current data suggests the U.S. economy is moderating—not collapsing. Despite headlines warning of tariffs and policy uncertainty, experts and economic indicators are signaling a slowdown, not a recession.

After nearly two years of outperforming expectations, the U.S. economy is showing signs of cooling off. But economists and policymakers agree: a recession isn’t necessarily around the corner.

Recent commentary from Federal Reserve Chair Jerome Powell framed the current climate as one of moderating, but healthy growth. During a press conference on March 19, Powell noted that while consumer spending and broader economic expansion have slowed slightly, they remain on a solid footing.

That sentiment was reflected in the Fed’s latest Summary of Economic Projections (SEP), which revised the 2025 GDP growth outlook downward to 1.7%, compared to 2.1% in December. Wall Street economists followed suit:

-

JPMorgan now forecasts 1.6% GDP growth (down from 1.9%)

-

Morgan Stanley revised to 1.5% (from 1.9%)

-

Goldman Sachs projects 1.7% (down from 2.4%)

While those revisions reflect weaker momentum, none signal a looming recession. Goldman, for example, raised its 12-month recession probability to 20%—only slightly above the historical baseline of 15%.

The Disconnect Between Sentiment and Reality

Despite that relatively stable outlook, consumer sentiment and market perception have deteriorated. The betting platform Kalshi now prices in a 40% chance of a recession within a year—double what it was just six weeks ago. Similarly, the Atlanta Fed’s GDPNow model has sparked concerns with a projected near-2% contraction in Q1 2025.

Yet economists warn against overreacting to “soft data” like surveys and consumer sentiment indexes. These can be highly reactive to headlines—especially surrounding Trump-era tariffs or potential federal job cuts. Hard data, such as retail sales and employment trends, tells a different story.

Morgan Stanley’s chief global economist downplayed recession fears in a recent note, suggesting that “crises about recession are probably overdone.” He cited the bounce-back in February retail sales as a prime example of the economy’s underlying resilience.

Recent Data Underscores Slowing, Not Stalling

-

S&P Global’s flash U.S. composite PMI for March hit 53.5, a rebound from February’s 51.6, beating expectations.

-

Consumer spending cooled in January, but only after several months of unsustainably high growth in late 2024.

-

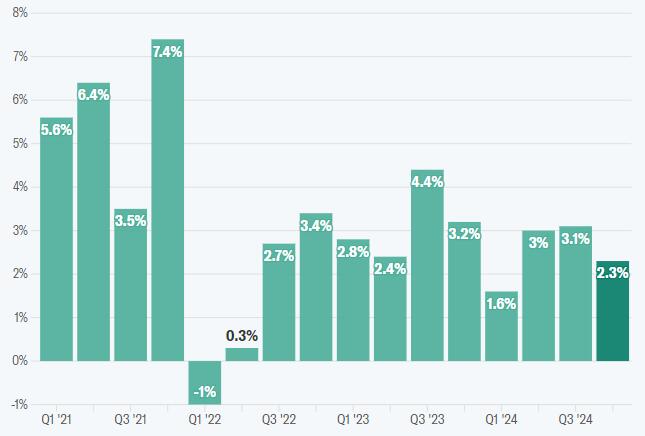

S&P Global’s economic model estimates a 1.5% annualized GDP growth rate for Q1 2025, down from 2.3% in Q4 2024.

Lori Calvasina of RBC Capital Markets notes that U.S. equities often struggle when GDP growth ranges between 0.1% and 2%, with markets faring worst when growth dips below 1%.

The Labor Market Remains a Bright Spot

According to Brett Ryan, senior U.S. economist at Deutsche Bank, the labor market is still performing well enough to support consumption. Unemployment filings remain low, and income growth—though slowing—hasn’t collapsed.

“If we started seeing monthly job losses or a sharp spike in unemployment, the outlook would change,” Ryan explained. “But right now, that’s not what we’re seeing.”

Final Takeaway

Yes, the economy is slowing—but it’s far from stalling. With the Fed signaling caution, consumer spending stabilizing, and the job market holding steady, current conditions don’t justify panic. A period of moderate growth appears more likely than an imminent recession, though continued vigilance remains key.